What We’re Watching: Lending rates: still (relatively) low

November 2022

Like most participants in financial markets, we follow the path of interest rates with a keen interest. What are central bankers thinking? Are they done hiking? How long is the lag between rate hikes and the impact on the economy?

But in our view Australia is a little different.

In Australia, we care as much about what the major banks are thinking. They are the ultimate transmitters of monetary policy deciding what to do with lending and deposit rates as well as deciding how much is paid by households versus businesses.

This month we thought we would look at what these rates have done relative to the cash rate. At an aggregate level we know banks have expanded net interest margins but where has this expansion come from?

Let’s start with deposit rates.

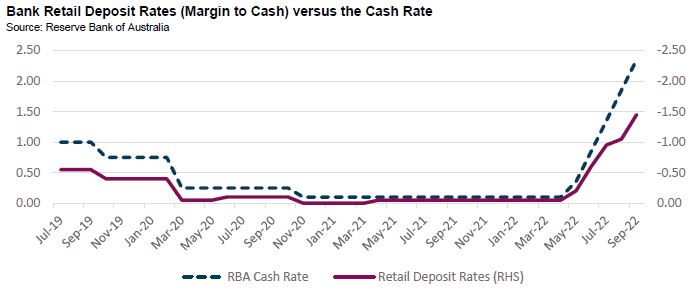

The below chart shows that banks have only passed on around one third of the benefit of higher interest rates to retail deposit rates. Historically (going back to 2004) banks would pay slightly (0-0.5%) less than the RBA cash rate for deposits. Currently they are paying 1.6% less than the RBA cash rate. Prior to COVID the worst rate we observed was 0.65% less than the cash rate.

The story is similar albeit slight better from the perspective of the household with respect to term deposit rates where banks are pricing slightly below government bond rates and well below swap rates of equivalent term.

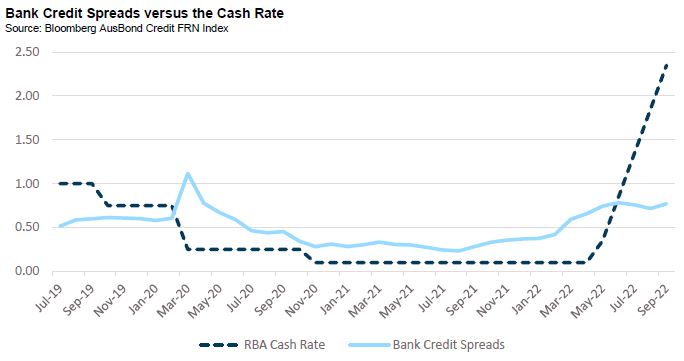

In wholesale markets banks are actually paying more. Here we show that since bottoming in August 2021 credit spreads have increased by over 0.5% and now stand at 0.77%. With new a benchmark 5 year senior unsecured transaction pricing at over 1.2% over bank bills, it is likely to increase further.

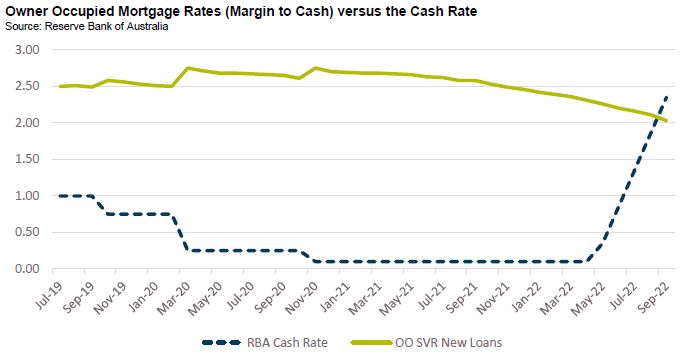

On the lending side banks have actually given back margin to the household and are effectively earning less on a mortgage than they were six months ago. Of course, there is a lagged impact on this. Based on advertised lending rates, owner occupiers are paying 1.6-2% over the RBA cash rate compared to around 2.5% over cash in the years prior.

It is hard to overstate how difficult this environment has become for non-bank lenders who rely on securitisation funding. With bank credit spreads widening, funding costs have increased dramatically. Historically large institutions (i.e., banks) priced their mortgage portfolios slightly wide of market. Now they are inside. A subset of non-bank lenders we track have actually increased mortgage rates by 0.5-0.6% more than the RBA cash rate. Relative to the cash rate non-banks have repriced their mortgages by more than 1%.

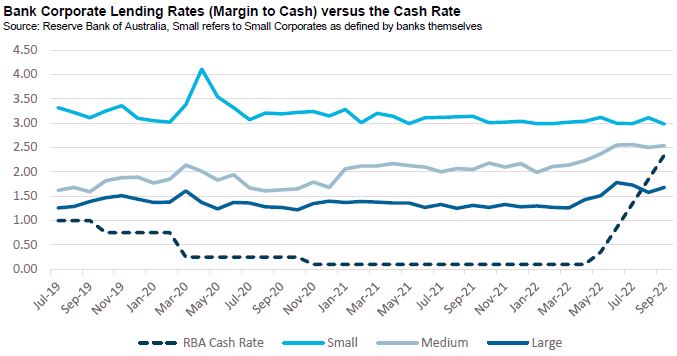

On the corporate lending side, banks have maintained a broadly flat margin for smaller borrowers but have expanded margins for medium and large sized corporate borrowers.

In the aggregate banks have expanded their net interest margins suggesting what they have given on mortgages they have more than taken back on deposits and, to a lesser extent, corporate lending to medium to large sized institutions. To illustrate, at their latest results ANZ reported an exit margin of 180 basis points, the highest level since March 2019 (but still around 0.50% lower than where it averaged in the years from 2015 to 2019).

So, what does all this mean going forward?

- Higher deposit pricing: We think banks will struggle to hold back on deposit rates. As wholesale funding costs increase and the Term Funding Facility and Committed Liquidity Facility expire, they will need to compete more aggressively for deposits;

- Flat NIMs: Bank NIMs are still low relative to historical levels. With funding costs increasing and expectations of higher losses, banks will need to consider the pricing on their asset portfolios in order to maintain NIMs at current levels

- Residential mortgage repricing: The largest asset held by the banks is residential mortgages. Over the next couple of years, a substantial percentage of mortgages are expected to exit fixed rate periods and convert to variable rates. We expect that banks will compete aggressively on these assets but struggle to see them pushing margins relative to cash much lower than they are now given the lack of competition from alternative lenders. We also expect more borrowers to fall out of bank criteria due to serviceability pressures.

- Corporate lending margins to expand: the combination of higher interest rates, higher expenses and slowing profitability will push margins wider to a point where alternative lenders of the public debt markets step in.

The upshot of all of this is that regardless of what the RBA does with interest rates, we expect both mortgage rates and corporate lending rates to steadily increase from here as the REAL central bank passes on its own cost of capital increases.

On behalf of the team thanks for reading.

Pete Robinson Head of Investment Strategy – Fixed Income

Unless otherwise specified, any information contained in this material is current as at date of publication and is provided by Challenger Investment Partners Limited (Challenger Investment Management or Challenger) (ABN 29 092 382 842, AFSL 234678), the investment manager of the Challenger IM Credit Income Fund ARSN 620 882 055 and the Challenger IM Multi-Sector Private Lending Fund ARSN 620 882 019 (the Funds). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante) is the responsible entity and issuer of interests in the Fund. Fidante and Challenger Investment Management are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com.au should be considered before making a decision about whether to buy or hold units in the Fund. Past performance is not a reliable indicator of future performance.

Fidante and Challenger Investment Management are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante and Challenger Investment Management. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.