What We’re Watching: Our quarterly review of markets – March 2024

April 2024

Market Review & Outlook:

Non-Financial Credit:

Summary views: rally in public market spreads has reduced the appeal, particularly in high yield. Despite signs of fundamental weakness there is better relative value in private markets.

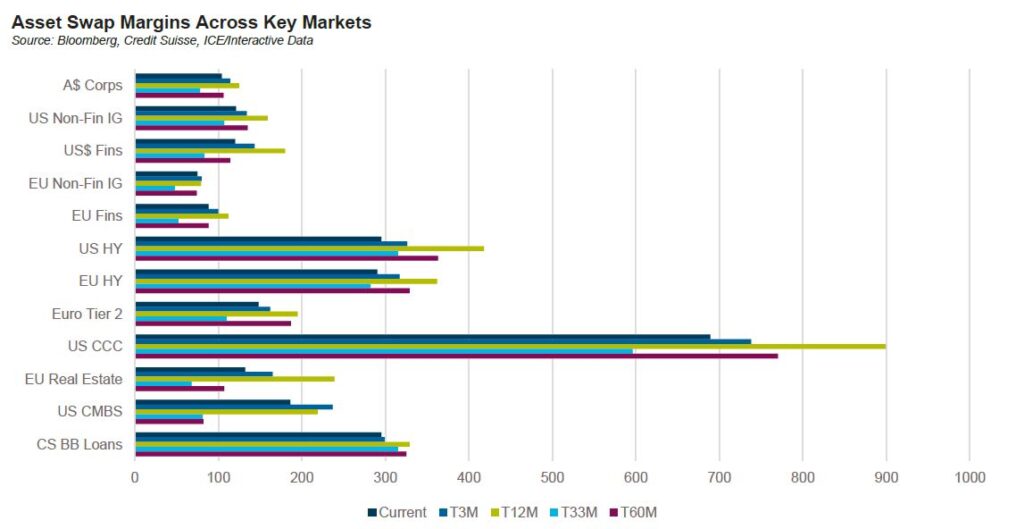

Credit continued to rally for much of the first quarter before showing some tentative signs of stabilisation. Spreads have settled at around 50-60% of the 2022 wides but still wide of the post COVID tights.

A theme we have called out previously is the expensiveness of high yield relative to investment grade credit. The US high yield index is trading below 300 basis points in asset swapped terms which is only 6 basis points from the mid 2021 tight level of 289 basis points. In contrast, US non-financial investment grade credit is still 18 basis points wider than the tight levels. Interestingly, distressed credit is trading around 30% wider than the tights while BB rated credit is trading inside the 200 basis points in asset swapped terms which is inside the post COVID tight level (B-rated credit is trading similarly).

The story is similar in Europe and applies for loans as well as bonds. So, what gives? Why is high yield credit performing so strongly?

Firstly, fundamentals have thus far proved resilient to higher interest rates, far more than we and many others anticipated. Due to the rise in interest rates interest coverage levels have continued to decline. Interest coverage for US leveraged loan issuers is now in line with the lows during COVID and approaching post GFC lows. This is despite generally strong earnings which have stopped leverage from increasing too sharply. This story is similar to the investment grade market which has seen strong earnings growth (Citi reports 12M EBITDA YoY growth of 4%) ensuring leverage has only ticked up moderately.

Despite the aggregate strength in fundamentals, there is meaningful dispersion with some borrowers significantly underperforming. Late in March, Altice, a French telecom, indicated that they may have to discount the value of their debt to reduce leverage. Altice France is the largest individual issuer of debt to European CLOs with an average exposure of around 2%. Across the wider market, Citi analysts have noted that loan downgrades by both S&P and Moody’s have continued in the first quarter. Moody’s cited a negative ratings drift that has persisted since mid-2022. Looking at leveraged loan markets weighted average ratings have continued to slide with the highest percentage of loans rated B3 or lower in the last decade. Trailing 12-month default rates remain elevated at around 5% with recoveries on 1st lien senior secured loans at 55%, below the 5yr average of 60%.

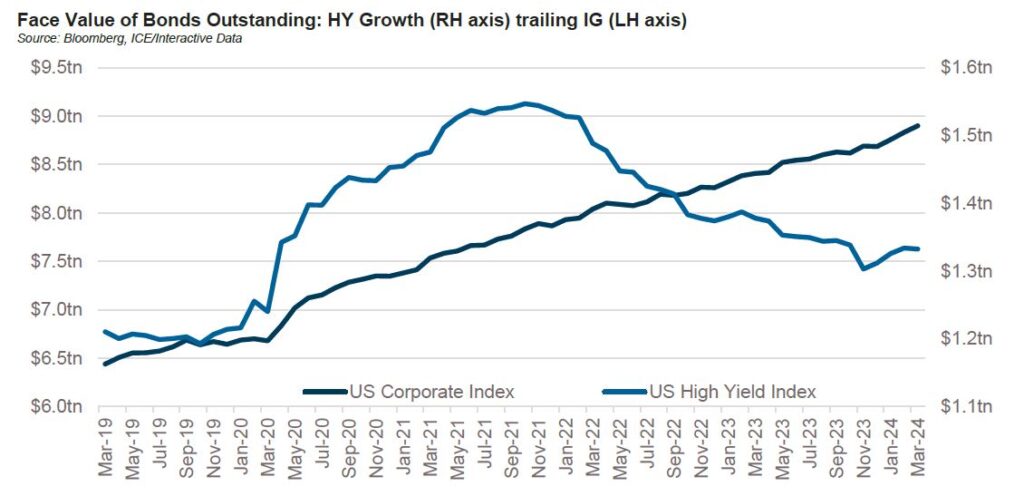

While fundamentals have been resilient in the both high yield and investment grade we suspect the bigger story is related to supply. US investment grade markets have seen the fastest pace of issuance on record with over US$500 billion issued in the first quarter. Issuance within high yield markets did pick up in Q1 but has only moderately offset the effect of maturities and positive ratings migration. The ICE/BAML US High Yield index has a face value of US$1.3 trillion, up around US$20 billion for the quarter but still well below the peak level of US$1.5 trillion. Similarly leveraged loans have been flat at around a similar size to high yield bonds.

Of course, offsetting the lack of growth in high yield markets has been the growth in private direct lending markets. Estimates of the overall market size are hard to come by but most come in around US$1.5 trillion. Here the story is more mixed with illiquidity premiums seeming to come in at around 2%. Trailing defaults have been lower than broadly syndicated loan markets but interest serviceability appears more challenged with a weighted average interest coverage ratio of below 1.5 times, compared to above 3 times for broadly syndicated markets.

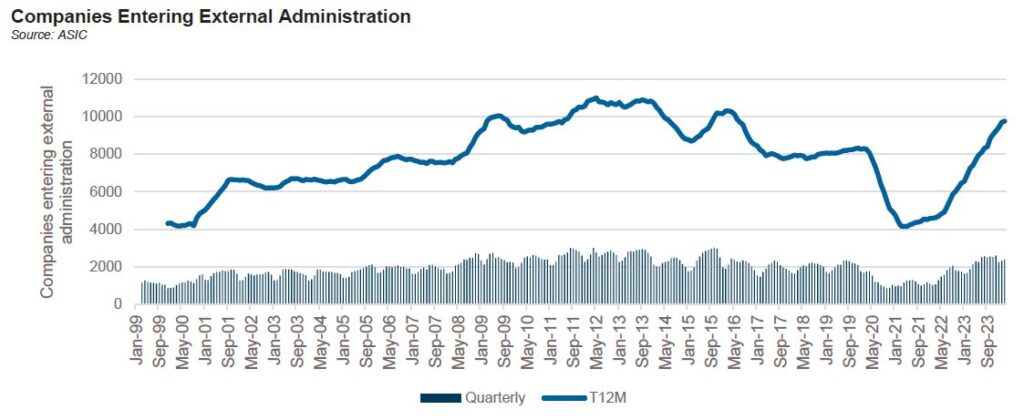

Domestically companies entering external administration has continued to rise in 2024. The first quarter was the worst start to the year since 2013 and the third worst going back to 1999. There is also evidence of more widespread pressures beyond the construction sector with high profile names such as Godfrey’s, Nature’s Care, Tigerlily, Melbourne Rebels all calling in the administrators over the past quarter.

Despite some fundamental weakness deal flow has been continued. CIM reviewed 33 corporate deals in the first quarter, proceeding with only 5, the team’s busiest first quarter on record in terms of total deals reviewed.

Financial Credit:

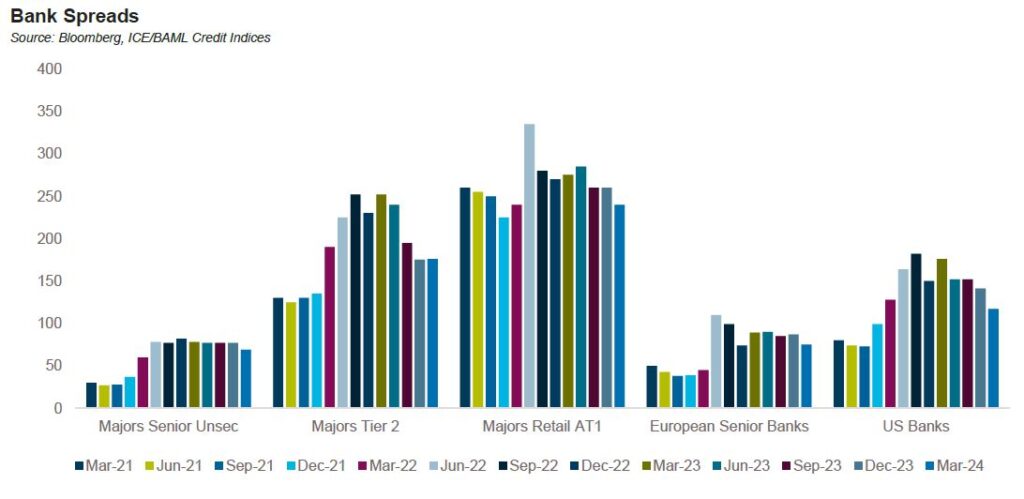

Summary views: offshore financials have lagged corporates and look attractive despite a weakening macro outlook with Australian dollar AT1 securities flagging as expensive.

The biggest news for the domestic financial sector came late in the quarter as S&P upgraded Australia’s Banking Industry Country Risk Assessment (BICRA) from 3 to 2. This resulted in an upgrade to S&P’s stand alone credit profile for all Australian banks. The net impact was that all tier 2 bonds were upgraded with major banks moving to an A- rating. Additional Tier 1 (AT1) instruments were also upgraded by 1 notch with the major banks moving to a BBB rating. Senior unsecured bonds for the major banks were unchanged as S&P reduced 1 notch of government support.

The news was largely priced with tier 2 paper flat over the quarter, lagging offshore financials which tightened strongly in both Europe and the United States. European AT1 is trading in the mid to high 400s in z-spread terms remaining well wide of retail issuance by the major banks in Australia. European investment grade rated Tier 2 paper is trading in the high 100s, in line with the domestic banks. The degree of tightening has taken call risk off the table for now with the bulk of the market trading well inside reoffer levels.

Relative to corporate paper, financials look cheap with spreads around 50 basis points from the tight levels of 2021.

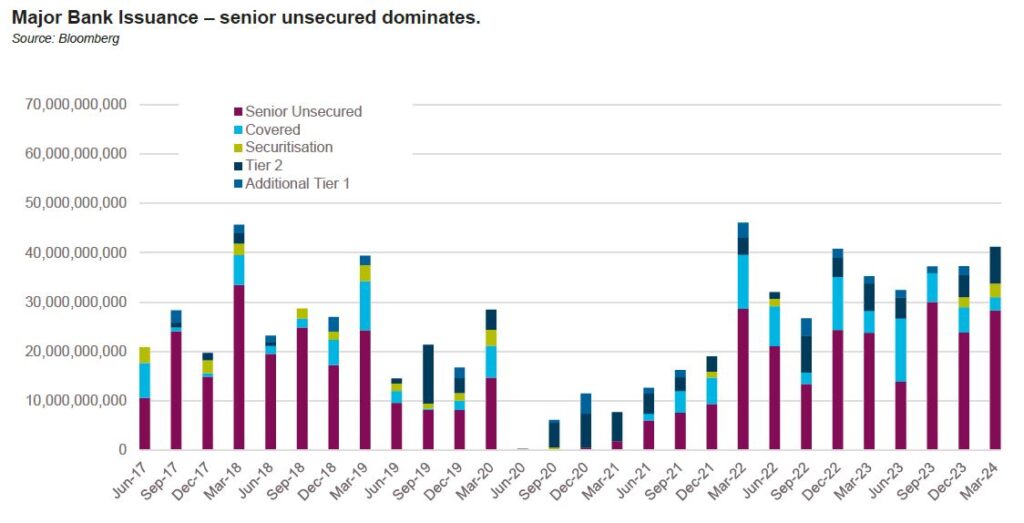

The first quarter of 2024 saw strong issuance from the domestic major banks with over A$40 billion in issuance, mostly focussed on senior unsecured paper as banks pre-funded maturities from the Term Funding Facility. Offshore AT1 issuance has returned strongly with European banks already issuing EUR10.9 billion year to date, close to 40% of 2023’s full year issuance levels. Tier 2 issuance was similarly strong with European bank issuance at close to 50% of 2023’s full year issuance.

Fundamentals from both the domestic and offshore banks remains relatively strong with the exception of the US regional banks. The KBW regional bank index was down 6% for the quarter, contrasting with the KBW banking index which was up 10%. The underperformance of regionals can be attributed in large part to the issues in the commercial real estate sector. As a reminder banks hold half of all real estate debt in the United States with regional banks accounting for around 70% of all commercial real estate bank loans outstanding.

In Europe bank net interest margins remain close to peak levels at around 1.7% with returns on equity in the double digits. Non-performing loans seem to have bottomed and may already be increasingly slightly. The story is similar domestically with major bank net interest margins in the 1.5-2% range and non-performing loansticking up slightly to 0.95% in December 2023 up from a low of 0.8% in December 2022.

ABS & Whole Loans:

Summary views: a strong technical bid has driven spreads close to post COVID tights, especially in investment grade rated tranches. Arrears have trended up but remain well inside trigger levels. Private markets have seen non-traditional buyers come into the market.

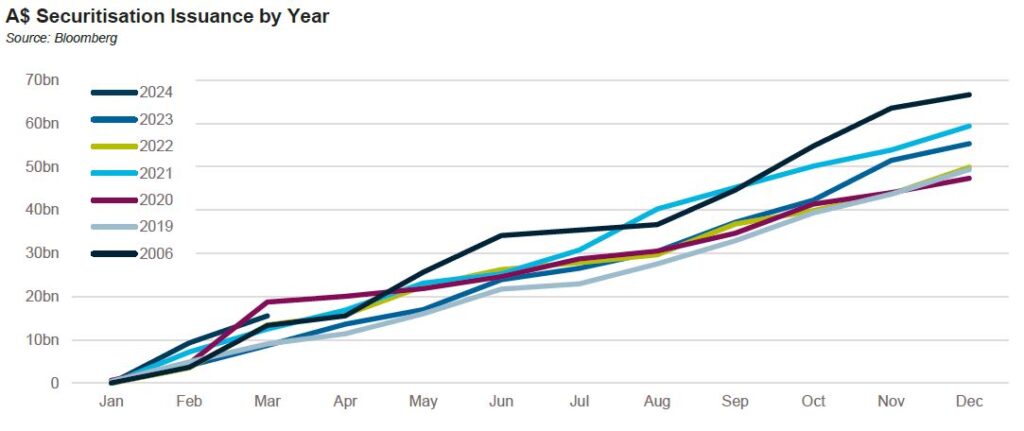

The favourable conditions from the fourth quarter continued into 2024 leading to strong issuance levels. The $15 billion issued in the Australian market was the largest volume since 2020. Around 10% of total issuance was rated below AAA with only around $200 million of issuance rated below investment grade.

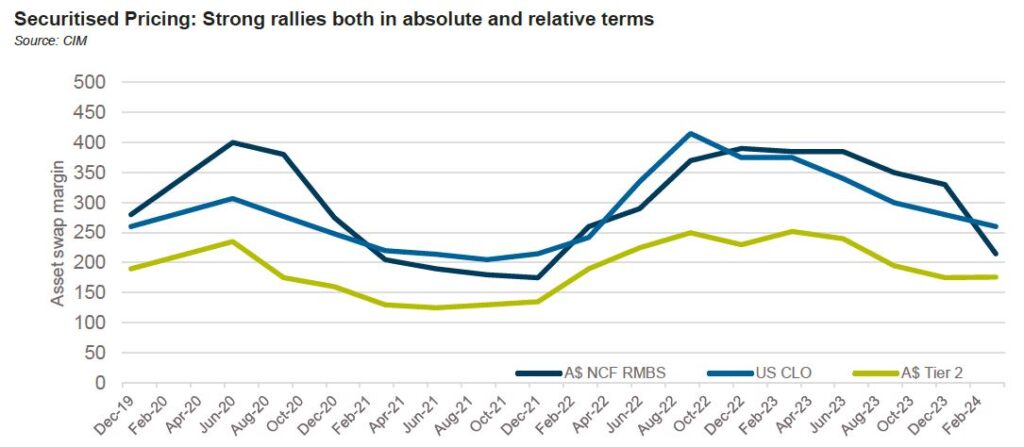

Market pricing rallied strongly in the first quarter both in absolute and relative terms. Single A rated mezzanine paper is approaching margins of 200 basis points, only around 20 basis wide of tier 2 paper issued by major banks. This differential is the smallest since late 2021 when A-rated spreads were trading below 200 basis points. Not also that the spreads below are not adjusted for basis swap differentials which are currently worth around 10 basis points (i.e., for a 3 year bond a margin of 200 basis points over 1 month BBSW is equivalent to around 190 basis points over 3 month BBSW).

Pricing differentials between Australian and European markets have also declined, particularly in investment grade rated tranches where single A rated mezz is trading close to flat today compared to a basis of around 50-75 basis points (pre-cross currency swap) at the end of 2023.

Sub-investment grade tranches have generally lagged the rally in the market. Single A-rated non-confirming RMBS was 115 basis points tighter over the quarter with BB-rated tranches only 95 basis points tighter. Offshore markets have tended to rally more in the sub-investment grade part of the capital stack with UK BB-rated RMBS tranches trading at a margin of around 300 basis points compared to 535 basis points in Australia. The CLO market rallied strongly over the quarter but still trades wide with BB rated tranches trading at around 770 basis points.

Reflective of the bid tone in markets, two names which had previously been eschewed by the market found some support. Athena, a VC-backed prime mortgage lender which had seen its loan book shrink as it struggled to reach profitability, priced a $1 billion RMBS in March at minimal concession to other non-bank issuers. Zip Group, who priced BBB’s in a securitisation in 2023 at a margin of 650 basis points, was able to clear the same tranche in 2024 at a margin of 365 basis points.

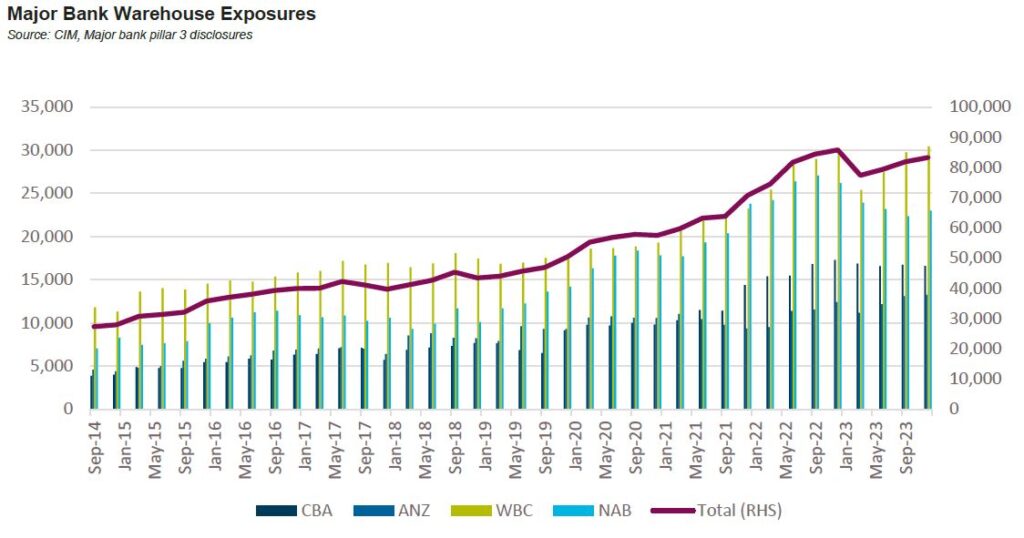

The positive tone has extended to private markets. While precise statistics are not available, major bank warehouse exposures have been on an upwards trajectory since bottoming 12 months ago though remain below the Q4, 2022 peak. Growth in non-bank financial institution aggregate credit outstanding was over 7% for the quarter ending in February 2024 though is only up 0.8% in the last 12 months. With strong public market issuance, we suspect that private markets have been broadly flat over the quarter as warehouses have been termed out. With supply contained, pricing has been driven by demand which has been strong with several investment managers launching new strategies specifically targeted towards private ABS markets.

Fundamentals remain relatively benign across the market but there are signs of weakening. According to the S&P SPIN index prime RMBS arrears are less than 1%, with non-conforming arrears at 4.2%. Non-conforming arrears are well off the lows of 2.0% in mid-2022 but remain below the COVID peak of 5.1% and slightly below the average levels from 2015-2019. Offshore arrears levels have risen across both RMBS and ABS with US subprime auto arrears standing out at close to 5% of loans at 60 days plus in arrears.

We’d caution that arrears statistics are heavily influenced by seasonality and new issuance but do provide some guide as to directionality of arrears from month to month.

Real Estate Loans:

Summary views: Fundamentals are poor and financial conditions continue to tighten. Despite this, non-bank lending markets remain open with no obvious signs of performance weakness.

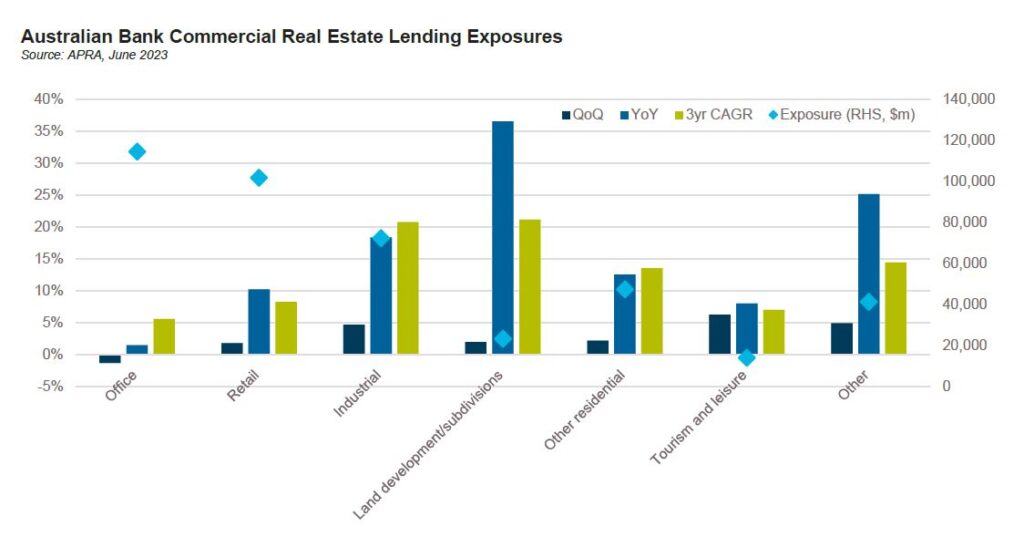

Domestic bank office exposure declined in the December quarter despite having jumped sharply in the September quarter. With close to A$115 billion in exposure, Office is the largest commercial real estate exposure on bank balance sheets but represents less than 3% of gross loans and exposures.

Bank reporting implies a moderate decline in credit quality. CBA showed that as at 31 December around 62.5% of their commercial real estate portfolio was below investment grade, up from 62% at 30 June although troubled and impaired assets declined from 1% to 0.7% over the same period.

The recent Financial Stability Review called out the prevalence of foreign buyers and lenders in the commercial real estate market. According to the RBA, foreign lenders are responsible for around 20% of all bank lending. APRA data shows that they are closer to 30% of bank lending to the office sector. The RBA’s April Bulletin also discussed commercial real estate with their analysis centred around financial stability risks stemming from non-banks. In the piece they call out non-bank lenders estimating that they account for less than 20% of direct CRE lending in Australia arguing that they do not pose systemic risks in Australia.

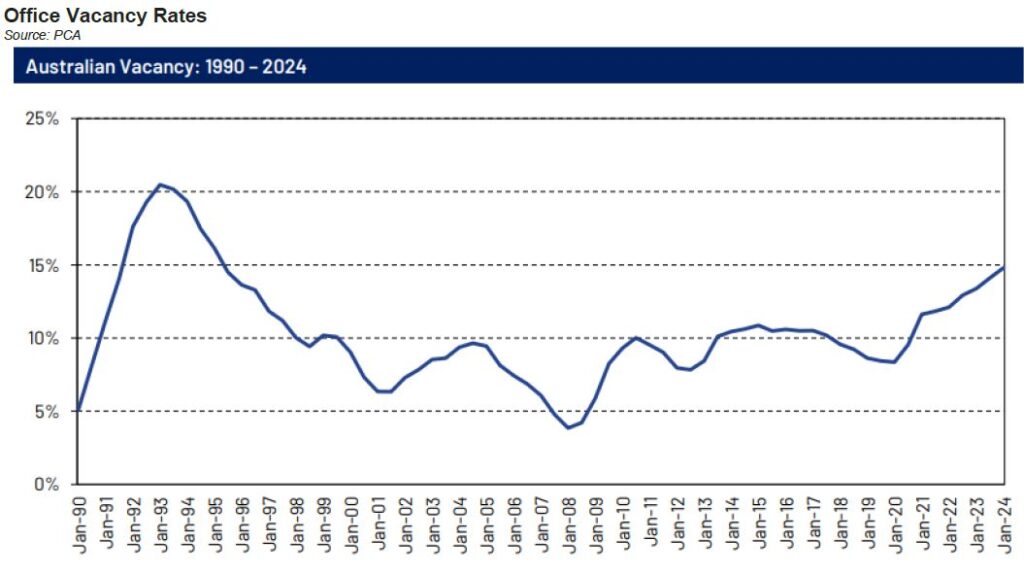

Despite regulators appearing sanguine on the sector, fundamentals have continued to deteriorate in line with offshore markets, especially within office. The NAB Quarterly Commercial Property Survey for Q4 2023 highlighted increasing vacancy rates and declining rents. The Property Council of Australia stated that office vacancies increased over the second half of 2023 ending the year at 15%, calling out a divergence between CBD and non-CBD markets.

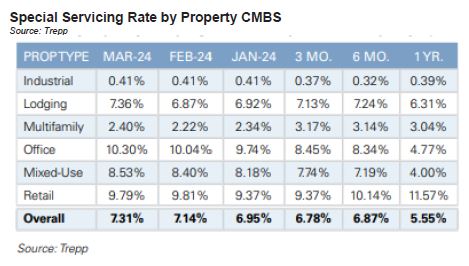

Offshore stress continues to build. National vacancy rates for office increased to 21.9% in the United States. CMBS special servicing rates on continued to increase in March driven by Office and Mixed-Use properties reaching 10.30% and 8.53%, respectively.

With so much stress in the market a large volume of CMBS transactions are being extended. Morgan Stanley reported that roughly 35% of maturing loans by balance for SASB (Single Asset Single Borrower) transactions paid off with less than 20% of office assets paying off. Domestically there is little data on extensions given so much of the market is funded by banks though anecdotes suggest a similar story in Australia. Activity in private markets is elevated, reflecting some of the underlying stress in the market.