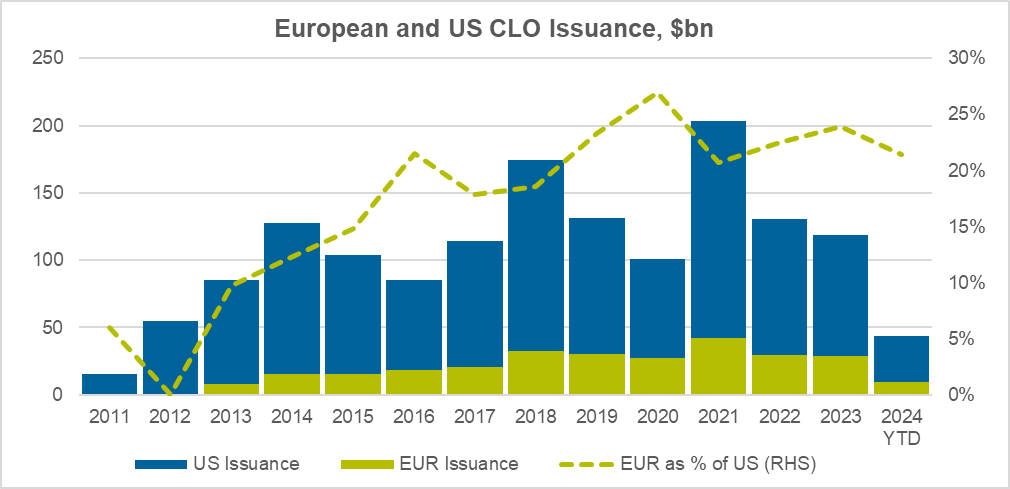

The US Broadly Syndicated Loan (BSL) Collateralised Loan obligations (CLO) market is the largest CLO market globally, with over $1trn of outstanding exposure. Investors can choose from 2000+ CLO issuances from 150+ CLO managers investing into a leveraged loan market featuring 600+ names. Despite the breadth of the US CLO market, expanding an investment universe to encompass the EUR CLO market presents a compelling opportunity for US investors.

Despite being around one fifth of the size of its US cousin in terms of issuance and outstanding balances, the EUR CLO market offers advantages over US CLOs including comparable or higher spreads, proven liquidity and robust historical performance, all under a stronger regulatory framework. Criticisms typically levied against the EUR CLO market are that it is too small, too illiquid, and too concentrated. As this market has evolved, we believe these criticisms are outdated and that EUR CLOs should be considered as an attractive complement or alternative to US CLO allocations.

CLO Background

Collateralised Loan obligations are typically floating rate bonds backed by a diverse pool of collateral comprised of loans to corporate borrowers. These portfolios of high yield loans and bonds are actively managed by firms specialising in the credit underwriting and monitoring of these assets. CLO coupons and principal repayments are paid from the cashflows generated by the underlying collateral and the various rated tranches in a CLO provide different risk (credit loss) and return (yield) characteristics. Along with BSLs, CLOs are increasingly being used to finance portfolios of middle market/private credit loans in the US although, given this is not yet established in Europe, we focus on comparisons between the US and EUR BSL CLO markets.

Source: Morgan Stanley, Intex as at 31 March 2024.

European CLOs are increasingly liquid

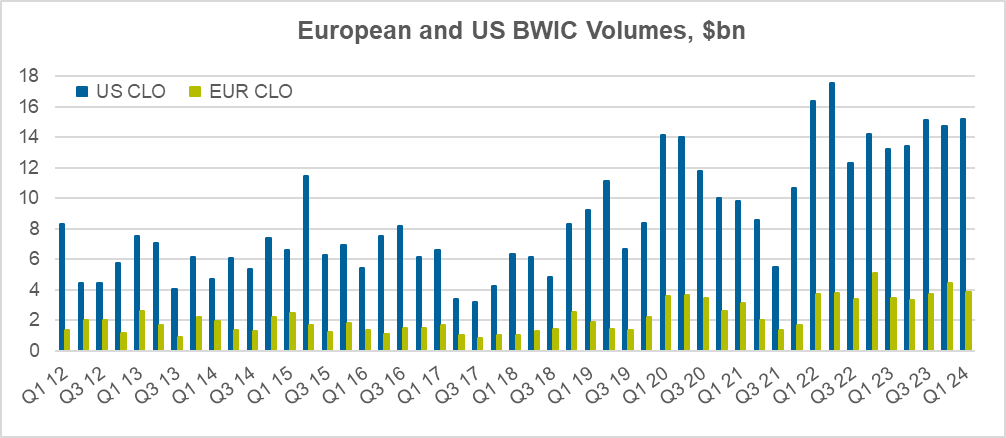

While the European CLO market is notably smaller than the US market, it demonstrates good liquidity characteristics. Trading volumes have increased to a healthy level in recent years – the chart below shows quarterly BWIC volumes which are sufficiently high in relation to the European CLO market size, averaging roughly $4bn / ~1.5% of the outstanding market per quarter.

Source: Morgan Stanley, Intex as at 31 March 2024.

Furthermore, the market has maintained liquidity during periods of market stress. During the UK Liability Driven Investment (LDI) crisis in September/October 2022, many investors were able to raise liquidity from within the UK and European ABS/CLO asset classes. EUR CLO AAA and AA were particularly attractive sale candidates as in the rising rate environment precursing the crisis, given their floating rate and high rating quality, they had suffered comparatively little mark-to-market losses when compared to longer dated fixed rate bonds. We estimate that over the 3-week period marking the LDI crisis, roughly $15bn in securitised products was traded, a large portion of that comprising AAA/AA CLO bonds.

As well as liquidity, CLO manager diversity has improved in the EUR CLO market as the market has grown. There is an established group of managers, which continues to grow at around 65 managers at present, each with their own slightly different style and approach to credit management. This gives CLO investors the flexibility to choose the style of manager that best fits their investment considerations, whether that be investment style and philosophy, performance of previous transactions or the tenor and ratings of bonds offered.

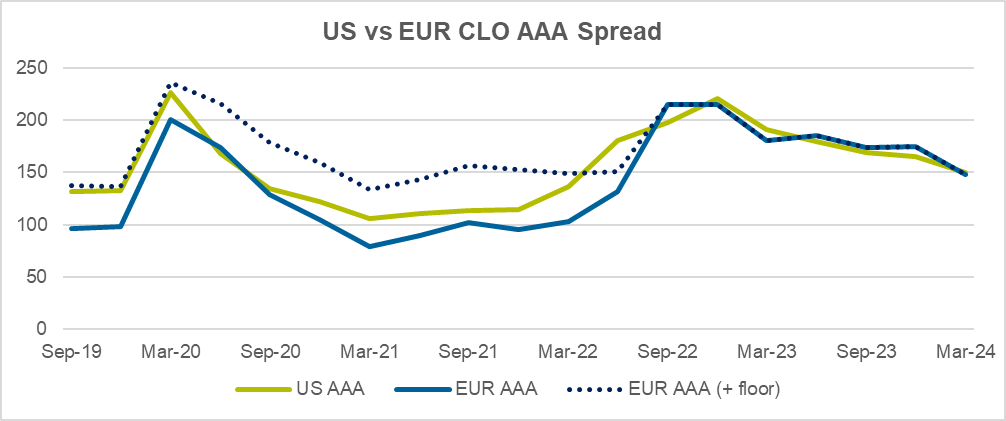

Returns are attractive compared to US CLOs

EUR CLOs often present attractive returns and compare favourably versus US counterparts. Until late 2022, AAA US CLO spreads in the post GFC era were wider than AAA EUR CLOs. This difference is generally explained by the negative European Central Bank (ECB) rate through 2013-2022 as the floating rate CLO spread is quoted over the reference rate floor of zero. Over 2023 these spreads have converged as the ECB raised interest rates, as shown in the chart below. In addition, EUR CLOs typically reference 3mth Euribor whereas US CLOs typically reference SOFR and so currently benefit from an additional cross currency spread pick up.

Source: Wells Fargo as at 31 March 2024, Challenger IM calculations.

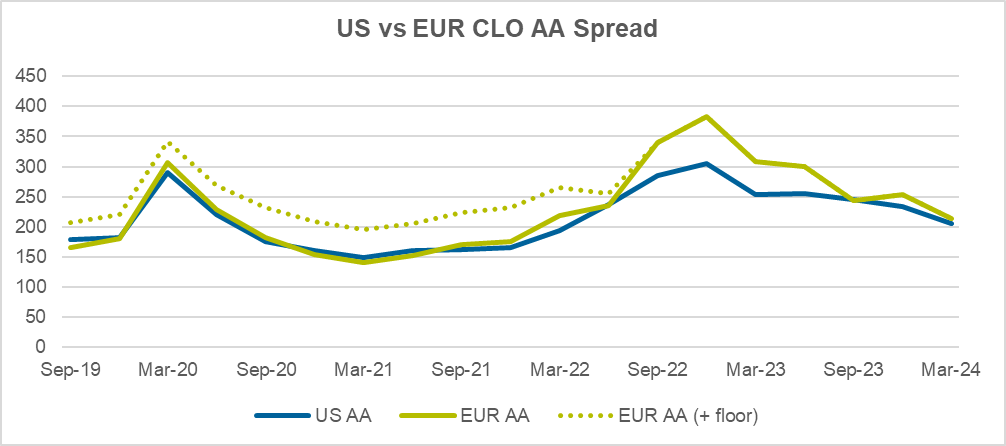

AA EUR CLO spreads have historically been slightly wider than AA US CLO, although this reversed in Q3 2022 with the widening of mezzanine EUR CLO spreads following the LDI sell off. This trend has persisted and at present, EUR AAs offer higher spreads and credit enhancement than equivalent US CLOs. Investors who are open to both US and EUR CLOs can dynamically allocate across ratings classes and geographies to take advantage of relative value shifts in the two markets.

Source: Wells Fargo as at 31 March 2024, Challenger IM calculations

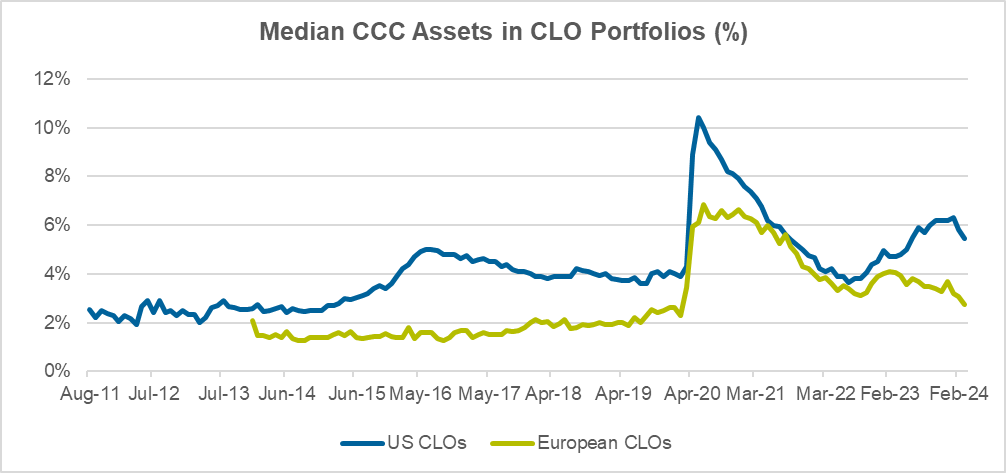

Asset pools demonstrate superior rating metrics in Europe

Liquidity and returns are not at the expense of the quality of the underlying collateral. European CLOs offer superior underlying asset ratings and performance compared to US counterparts. In recent years, US CLOs have had average higher concentrations of lower rated underlying assets. Currently, US CLOs have average allocations to assets rated single B and ‘CCC and below’ categories of 28% and 7.5% respectively, compared to European CLO allocations of 26% and 5.0%. Further European CLOs are able to diversify the underlying collateral pool from only leveraged loans by including a 10-20% bucket in fixed rate high yield bonds. Until recently, US CLOs were not permitted to include high yield bonds, although recent regulatory permission means latest US CLO transactions are now including a small (5%) allocation. The inclusion of high yield bonds generally means a manager can access higher rated collateral and which impacts the weighted average rating and diversity of the portfolio positively.

Source: Morgan Stanley Research, Intex as at 31 March 2024.

While the US has a larger diversification of underlying collateral shown by higher numbers of obligors (on average 300 versus 150 in Europe), European CLOs offer a unique diversification across different jurisdictions and therefore varying macro-economic environments. The UK, France and Germany make up 60% of collateral in outstanding CLOs. Due to the diversity of the European economies and industries, European CLOs can provide increased stability in underlying assets during periods of macro stress in specific jurisdictions.

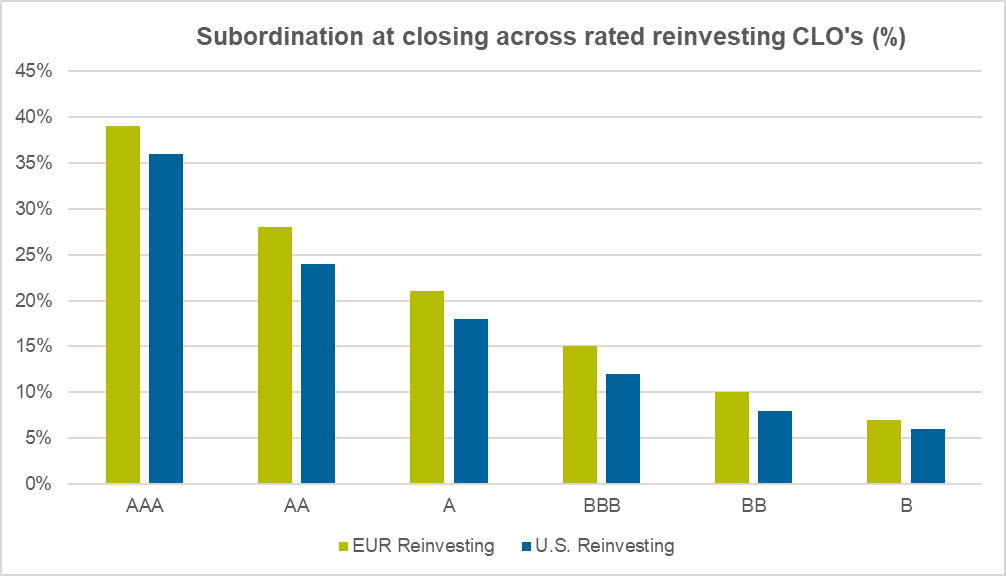

Structures are less leveraged in EUR CLOs

EUR CLOs exhibit strong credit structures. Protection for bond holders is higher in European CLOs, as a result of increased subordination of junior tranches in the structure, see chart below. At every rating, EUR CLOs have a higher subordination percentage than comparable US tranches.

Credit Rating agencies accept higher leverage in US structures as they give credit to higher number of issuers within the underlying collateral pool which increases the rating agency diversity scoring. This is higher in the US given the larger underlying loan market and demonstrated by the Moody diversity score which stands at ~78 in US vs ~57 in Europe.

Source: S&P Global Ratings, Data as at 1 August 2023.

The lower leverage in European structures typically makes them more resilient to downgrades. S&P data shows that in the second half of 2020 (of note due to the timing of the COVID pandemic), 471 U.S. CLO tranches and 27 EUR CLO tranches (12.4% and 2.6% of the outstanding US and European CLO tranches), were downgraded, demonstrating this structural resilience in Europe. Rating actions taken for EUR CLOs only affected the ‘BBB’, ‘BB’, and ‘B’ rating categories, whereas those for U.S. CLOs affected the other higher rating categories as well. In addition, we note that historically, impairments in EUR CLO bonds have also been lower. Between 1993-2022, US CLOs saw 0.5% material impairments versus 0.3% for Europe (S&P).

Regulatory oversight is stronger in EUR CLOs

As a result of increased regulatory oversight in global securitisation markets since the GFC, European securitisation regulations include policies which are particularly positive for investors in European CLOs. Along with disclosure requirements, regulations include a requirement for 5% risk retention by the CLO manager, helping to drive alignment between CLO managers and investors. This requirement is now absent from US CLO regulation, having been overturned in 2018 after being in place since 2014.

How does the European CLO market compare and provide a compelling opportunity to investors, despite criticisms against the sector?

An allocation to European CLOs positively expands the investment universe for US investors. Investors can take advantage of the increasing market size, diversity of jurisdictions, higher quality collateral metrics and structures, without compromising returns on investment.

Important Information

This material has been prepared by Challenger Investment Partners Limited (Challenger Investment Management or Challenger), ABN 29 092 382 842, AFSL 329 828. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.

This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Challenger Investment Management nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.