Securitisation warehouses, a type of private asset-backed securities, are the pre-curser to public asset-backed securities. They can offer a substantial yield pickup over public markets and investors can gain attractive risk-adjusted returns and meaningful portfolio diversification benefits from this sub-asset class. What are securitisation warehouses?

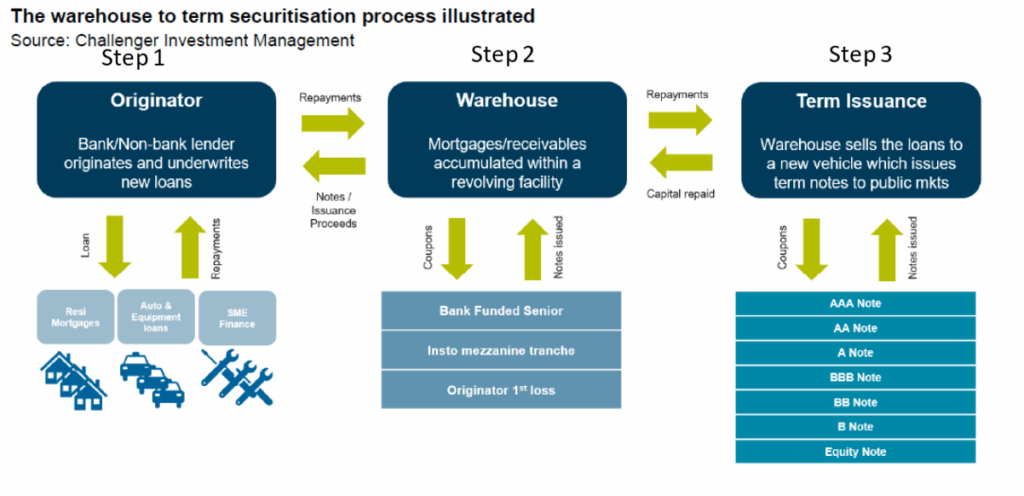

As discussed in our recent piece Introduction to Asset-Backed Securities, asset-backed securities are pools of loans/receivables which are securitised and tranched into bonds of different risk-return profiles and issued in public markets. The underlying assets include mortgages, auto loans, and consumer loans. However, before a pool of assets can be securitised into public residential mortgage-backed securities (RMBS) or asset-backed securities (ABS), the lender must accumulate a sufficient volume of loans to pool together. Warehousing, or pre-securitisation finance, provides financing to allow a lender to accumulate these loans before they are securitised and issued in public markets. As a result, they tend to be relatively short tenors, usually between 12-24 months.

In a similar structure to a public asset-backed security, the warehouse is tranched into the top senior tranche, the mezzanine tranche and the originator first loss/equity tranche. The senior financier of the top tranche is typically a bank who will also act as the arranger of the public transaction once sufficient loans have accumulated and the pool is ready to be securitised and publicly issued (step 3 in the diagram below). The lower equity tranche is usually funded by the originator, helping to the aligning interests of the originator of the loans and the warehouse investors.

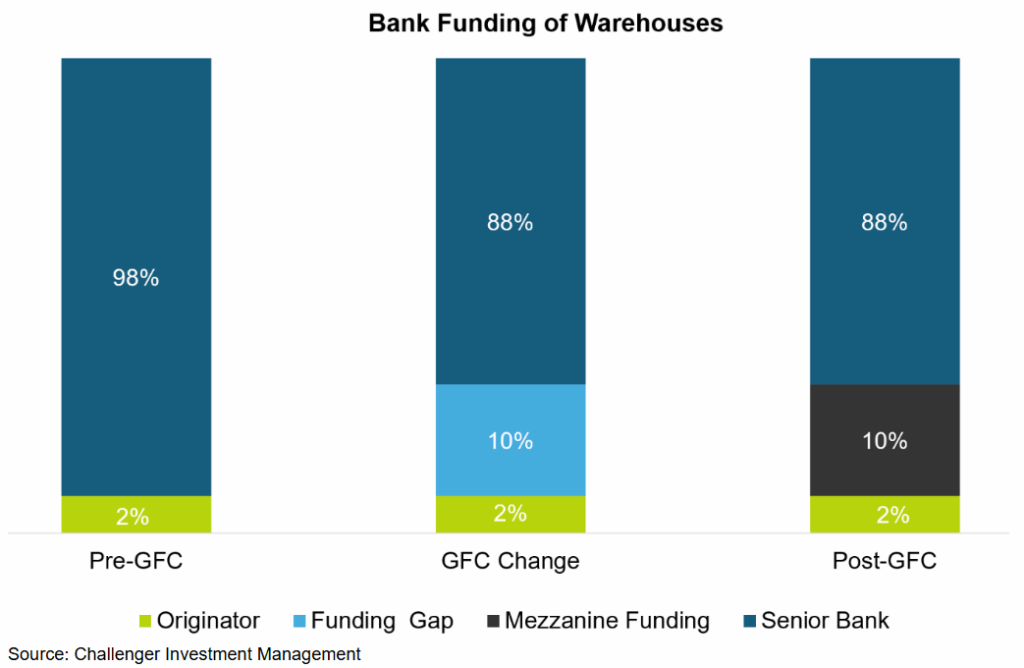

As for the mezzanine tranche, this warehouse lending opportunity has emerged as a result of changing banking regulation. Prior to the GFC, banks were willing to fund the proportion of the warehouse now funded by the senior and mezzanine tranches. However, in the period after the GFC, regulation and increased capital requirements have led banks to advance less against the same pool of collateral. This left a structural gap in funding for the mezzanine tranche and alternative lenders like Challenger IM have stepped in to fund this space.

The opportunity in securitisation warehouses

Attractive risk-return dynamics: Warehouses provide an attractive pickup over public markets. Being a type of private credit, they are not readily tradeable and hence provide an illiquidity premium. Moreover, originators, or issuers of the loans, need flexibility and a partnership approach to ensure these facilities run smoothly. For alternative lenders like Challenger IM providing the mezzanine finance, the margins in warehouses are generally around 150-200bps per annum higher than the margins in public term transactions of the same implied credit ratings.

Floating rate: Most securitisation warehouses are floating rate, benefitting from higher returns in a rising rate environment but with low interest rate duration, especially compared with traditional fixed income investments.

Short tenor: Being short-term financing, the tenor of private ABS warehouses is typically around 12-24 months, significantly shorter than both traditional fixed income investments and public ABS bonds. This limits the sensitivity of warehouses to credit spread duration, helping to lower volatility and correlation with traditional asset classes.

Revolving facility: Warehouses are generally revolving facilities. At the end of the facility period, originators can roll the facility at the prevailing market pricing rather than establish a new facility. Typically, warehouse investors will roll these exposures multiple times as part of a long-term relationship with the originator. This reduces the costs associated with replacing facilities with new deals and means investors can continue to access these attractive returns for a number of years.

Access to other investment opportunities: Funding a warehouse requires a long-term, partnership approach to lending. Warehouses are at the heart of non-bank lending business models and relationships can be long lasting. Being a warehouse provider can generate preferential access to term securitisations and other funding opportunities generated by the non-bank lender.

Risks of securitisation warehouses

It is important to understand the risks associated with securitisation warehouses, including:

Credit risk: Securitisation warehouses are backed by assets and therefore their value depends on the creditworthiness of the underlying assets. Defaults in the collateral pool will affect the performance of the warehouse. As such, it is important to understand the credit quality and risk of default of the underlying assets through in-depth analysis of granular asset-pool data.

Liquidity risk: Securitisation warehouses are not publicly traded and lack a liquid secondary market, and as such are considered part of the private credit market. Liquidity is generally only available when the warehouse facility matures, typically after 12-24 months. As a result, investors are compensated for this with an illiquidity premium. Furthermore, during a period of market volatility where term markets may be shut or refinancing unavailable, cash may be locked up and a facility could be extended for a period of time. For managed funds investing in securitisation warehouses, careful portfolio construction is important to ensure the liquidity objectives of the fund can be met even if this occurs. This could mean limitations on the amount of private ABS in a portfolio or including other assets to support liquidity until markets reopen.

Market risk: While securitisation warehouses are considered private credit and are not publicly traded, properly marking these securities to market means that prices can move in response to the market and economic environment and investor sentiment. The short duration nature of these investments mitigates this somewhat.

Operational risk: Private ABS investing is very operationally intensive. Extensive middle and back office support is required to meet the demands of warehouse investing, such as documentation, legal requirements and capital calls. A well-resourced team is essential to meet the operational needs of investing in this asset class.

Interest rate risk: Most securitisation warehouses have floating interest rates, so their market prices are not typically impacted directly by rising or falling interest rates. However, the total coupon paid on the warehouse investment will vary as the floating reference rates change. Moves in interest rates can also impact the performance of the underlying assets, like prepayment rates and arrears. Where floating rate securitisation warehouses are backed by portfolios of fixed rate loans, transactions also typically contain interest rate derivatives such as interest rate swaps to mitigate this mismatch, arranged with highly rated institutional counterparties.

Prepayment risk: For ABS warehouses of mortgages, borrowers repaying their loans ahead of schedule impacts the expected cash flows. If this occurs, typically the originator would top up the warehouse overtime, limiting the impact of prepayments. However, in the event that a warehouse isn’t topped up, prepayment may impact the expected cash flows on the investment.

Further considerations when investing in securitisation warehouses

In addition to these risks, there are deeper considerations that must be understood in detail when investing in private ABS warehouses. Investors must examine the precise terms of each warehouse deal, including the following points, to ensure the mezzanine lender is adequately protected.

Intercreditor terms: The intercreditor agreement defines the rights and obligations of the lenders and includes what the senior lender can agree to without mezzanine consent. Aggressive documentation can cede consent rights around document amendments, waivers and audits to the senior financier only, disadvantaging the mezzanine lender.

Enforcement rights: These are the rights of the senior financier and the mezzanine financier if the warehouse is not performing as expected. Mezzanine lenders should understand what the senior lender can enforce without mezzanine consent and under what circumstances.

Financial strength of the originator: Warehouse investors should assess the ability of the originator to rectify the deterioration in the performance of the warehouse by adding subordination or buying back receivables.

Exit: It is important to determine whether the mezzanine lender is able to exit the facility in the event that they need to, without triggering an amortisation of the warehouse where senior is repaid in priority.

Given the complexity of private securitisation markets, investors must take a detailed approach to assessing originators, underlying loan pools, as well as the structure and terms of a deal. Challenger IM leverages its strong capabilities and experience in warehouses to offer investors access to the many benefits of this space while seeking to minimise downside risks.

Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client’s objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report.