Market Review & Outlook:

Non-Financial Credit:

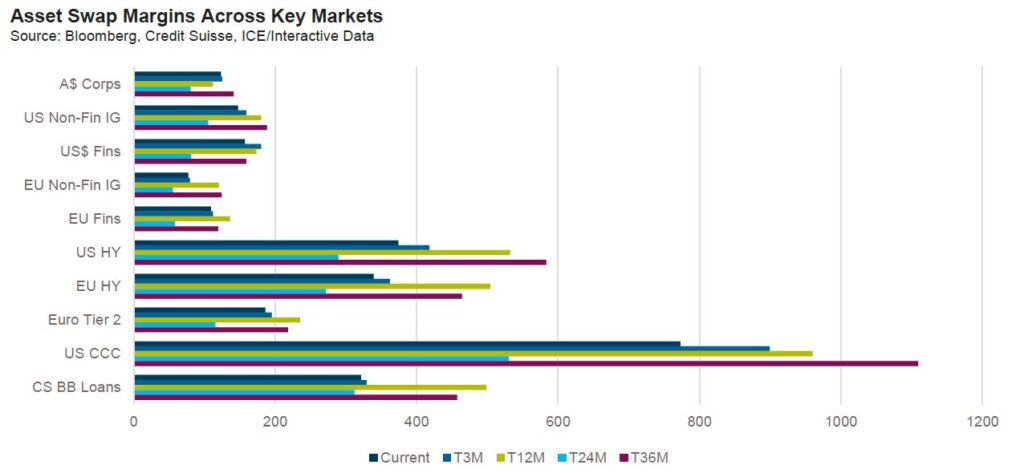

Summary views: fundamentals are continuing to deteriorate and defaults are picking up. Spreads are being held in by lack of primary issuance and are starting to look marginally expensive though illiquidity premiums in private markets are expanding.

Spreads rallied moderately across most parts of public credit markets over the June quarter. The rally was broad based across sectors and credit profiles. Spread volatility was relatively low, reflecting equity volatility which declined to the lowest levels since 2019.

Some of the tightness in spreads can be attributed to underwhelming levels of issuance. The non-financial bond market in Australia is down by 1% over the past 12 months and is showing limited prospects for growth.

According to Citigroup, fundamentals in the investment grade non-financial, non-energy sectors are weakening at a moderate pace. Earnings growth has turned negative resulting in an increase in net leverage even as total debt growth has declined. Weakening fundamentals has steadily turned the net upgrade ratio downwards with the ratio flat having been positive US$500 billion in face value only a few months ago.

Issuance in US high yield markets has also been light. If the current pace is sustained, we are on track for the second lowest year of issuance since the GFC (2022 was the lowest). Citigroup notes that if we risk adjust (i.e., riskier issuance is worth more), 2023 is on track to be the lowest year of issuance implying only the strongest credits are able/willing to issue into this market. Issuance is becoming shorter as well with the average maturity at around 6 years having averaged around 7-8 years up until 2022. The net result is that the average maturity of high yield credits is getting increasingly short. Deutsche Bank researchers found that as at the end of April 2023 22% and 29% of US and European leveraged issuers respectively, have maturity dates in less than 3 years. This is up around 10% on pre-COVID levels.

The risk aversion thematic extended to loan markets where primary issuance in the first half of 2023 came with a full turn less of leverage compared to previous years with much of the decline attributable to less use of junior debt.

Within private markets we continue to track interest coverage pressure closely. Using Ares Capital Corporation, the largest Business Development Company in the United States, as a guide for the wider market, interest coverage has declined to 1.7 times at the end of Q123 down from 3 times in Q421. Blackstone’s BCRED fund noted a 1.7 times coverage for Q2 with 4% of borrowers have interest coverage of less than 1 times.

The fundamental pressures are leading to higher default rates though not necessarily linearly. Proskauer’s Q2 2023 Private Credit Default increase was 1.64% for the quarter, a quarter on quarter decrease but still up to over 7% on a trailing 12-month basis. This compares to public speculative grade markets where Moody’s reported a 3.8% trailing 12 month default rate which they estimate peaking at 5.1% in early 2024 in their baseline scenario.

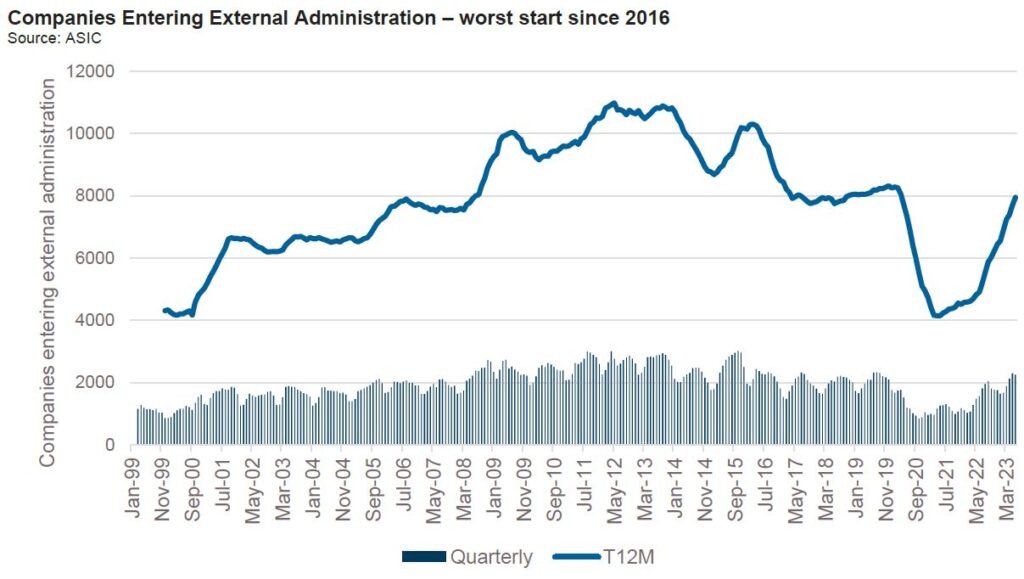

Domestically, defaults in private markets are still relatively low though we would caution that transparency is also much lower than the United States. Insolvency data is still showing increased levels of stress. Through the June half year end over 4,000 companies entered external administration, the worst start to a year since 2016.

Financial Credit:

Summary views: financials are an oasis of issuance in a primary market desert but sub debt in particular has rallied strongly and looks expensive.

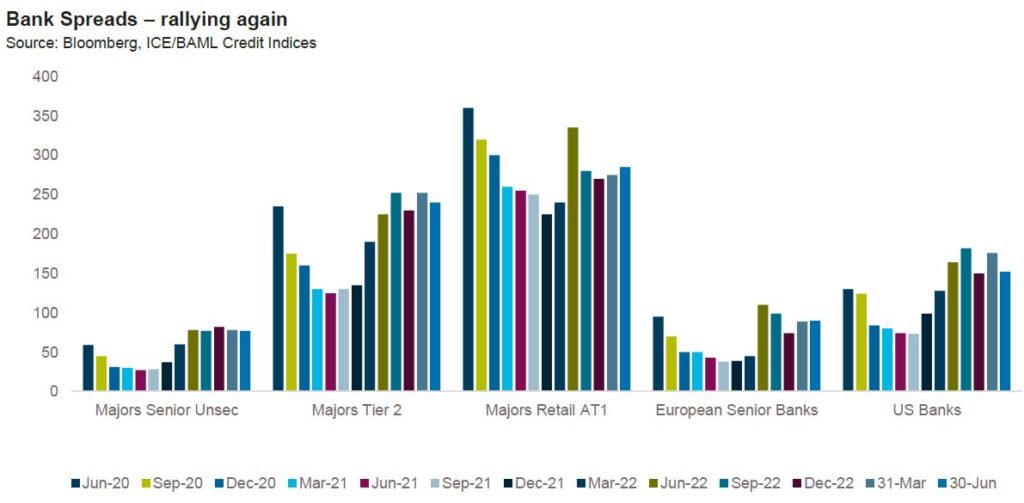

As a reminder it was only in March that Credit Suisse fell into the arms of UBS and fears of a US regional bank crisis were at their peak. Fast forward a few months and it is hard to see any evidence of the panic. Consider that:

- deposit outflows from US smaller banks have stabilised, currently sitting at US$5.2 trillion, around $80 billion above the lows in May; and

- US$15 billion in Additional Tier 1 debt was issued in June, the busiest month of issuance since September 2022.

Neither of these scenarios were conceivable in March.

With the wider credit market rallying, banks have caught a bid albeit not across all parts of the capital structure nor across all geographies. We had previously called out the domestic listed AT1 market as being expensive relative to Tier 2 especially in the face of the CS AT1 write down. This normalised over the quarter with AT1 spreads widening and Tier 2 spreads tightening. European banks also lagged, perhaps due to the greater fundamental weakness facing those economies (Russia’s invasion of Ukraine, elevated inflation, weakness in the property sector)

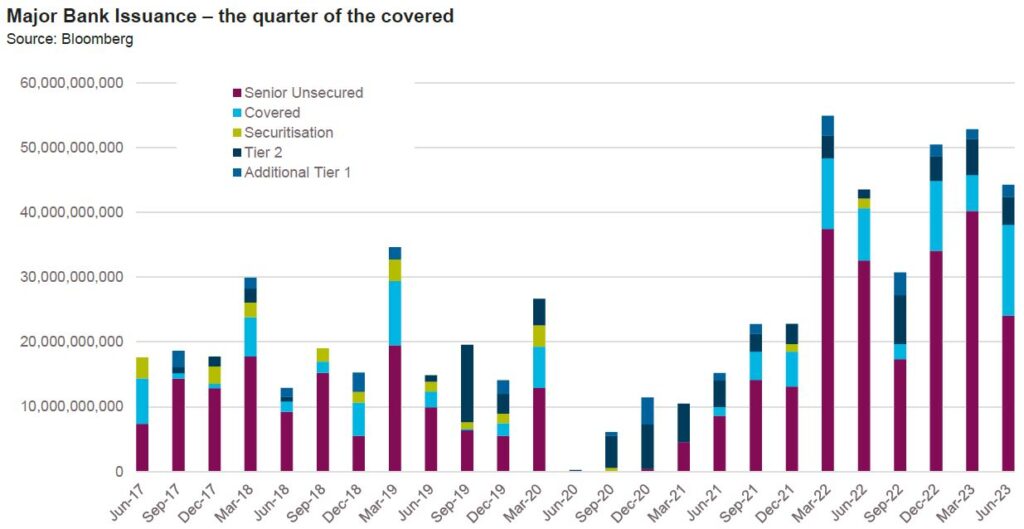

Domestically senior unsecured and Tier 2 debt continues to perform well. The pace of issuance, which had been elevated in recent quarters, slowed sharply with covered bond issuance replacing bank senior unsecured issuance. Indeed, by our count, covered bond issuance for the quarter was the highest on record.

We have talked at length about the upcoming end to the Term Funding Facility. Already $21 billion out of the $187 billion in drawn amounts has been repaid. While banks continue to extend credit readily (resident loans and leases are up 7% over the 12 months to 31 May) some of the pressure appears to be subsiding with pricing on mortgages and non-financial corporate loans abating, albeit only slightly.

From a funding perspective, deposit flows remain postive. Unlike the United States where money market funds actively compete with banks for deposits, Australia is a more closed system with flightly deposits most likely coming from financial and corporate depositors.

Fundamental risks for banks do appear low and really the questions facing the banks are around the sustainability of valuations at these levels. While we do not think banks are cheap, there does not appear to be a short term catalyst for a move wider, absent broader credit market stress.

ABS & Whole Loans:

Summary views: junior tranches represent attractive value compared to senior, technicals favourable as issuance is slowing, fundamentals are resilient to date

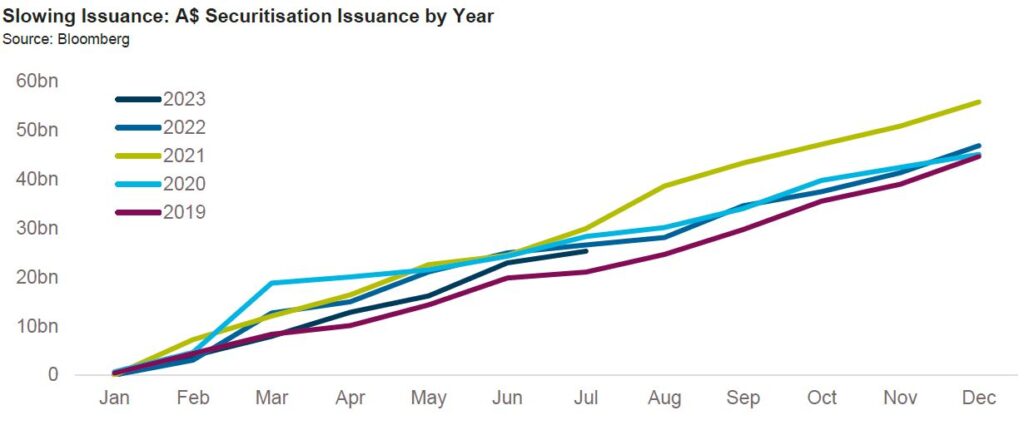

The Australian dollar securitisation market shrunk by $8.4 billion in the six months to May 2023, the largest decline since the Global Financial Crisis. The market is now $147.2 billion having peaked at $156.4 billion in June 2022. A combination of faster amortisation of existing deals and slower issuance of new transactions is driving the decline which looks likely to continue. S&P’s prepayment data shows that recent vintages are prepaying significantly faster than previous vintages with 2022 issuances tracking at 25% conditional prepayment rates and 2021 issuances tracking above 30%. To put in context, 2021 vintage RMBS is prepaying at over 5% faster than any previous vintage.

With better quality borrowers able to refinance at cheaper rates with banks, it is reasonable to see some credit burnout as securitisation pools are left with weaker borrowers. There is some evidence of burnout emerging with S&P SPIN index showing a small uptick in arrears.

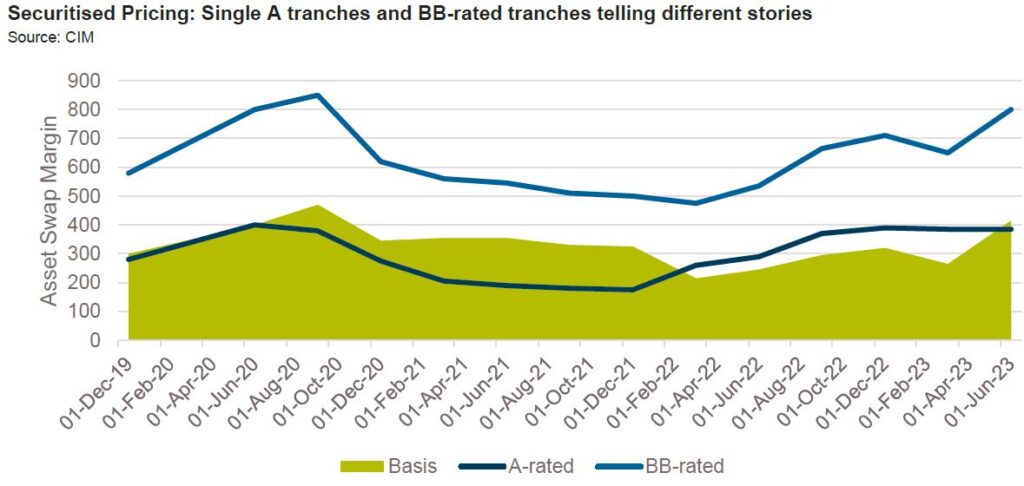

The key question is whether deals are deleveraging faster than arrears are rising. Markets seem to be pricing further increases in arrears and assuming that increased subordination (in percentage terms) will be insufficient compensation with spreads in junior tranches widening significantly relative to more risk remote tranches. The below chart shows the basis increasing to COVID peak levels for A$ non-conforming RMBS.

A shrinking market does not help the profitability of non-bank lenders who are heavily reliant on availability of credit securitisation markets to drive profitability. Listed non-banks are down an average of 29% over the last 12 months and 25% per annum over the last 3 years. Only Liberty Financial Group and Fleetpartners had positive 12 month returns. Additionally, 5 out of the 12 listed names were not profitable on a trailing 12 month basis despite very favourable funding conditions. We have previously warned about the risks in some non-bank lenders who have not yet reached a point of sustainable profitability and will struggle to raise capital without significantly diluting their shareholder base. Add to this the risk of higher arrears (and higher provisions) plus on balance sheet leverage which was predicated on much higher enterprise values and it is clear that the environment is challenged. Our view is that the unlisted non-banks are just as challenged as the listed non-banks, potentially exacerbated by the fact that valuations in the unlisted space likely remain significantly overvalued.

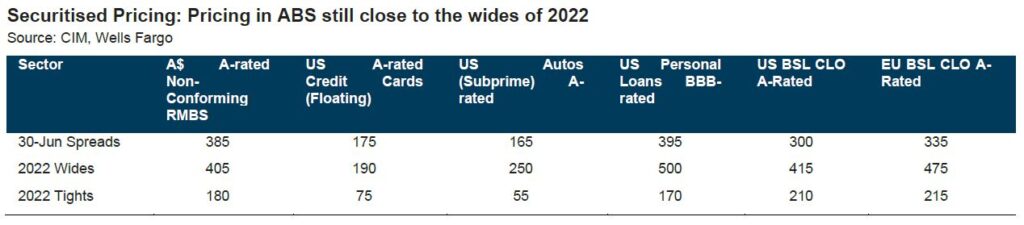

Moving offshore spreads have rallied but remain much closer to the wide levels of 2022 than the tight levels, especially in ABS markets. The one exception is the CLO market where current pricing is slightly closer to the tight levels of 2022.

While primary markets have slowed, unlike the story in Australia, the market outstanding continues to grow. This is especially surprising in the CLO market where the underlying leveraged loan market is shrinking. Notably, according to Barclays, the US broadly syndicated CLO market is now 68% of the performing leveraged loan market.

Moving to private markets, activity in warehouses has slowed across the market as overall production by non-banks has slowed. In the March quarter warehouses provided by the big 4 banks declined by 12%, the largest such decline over the past decade.

Real Estate Loans:

Summary views: Fundamentals are poor and financial conditions continue to tighten. Expect to see more private lending opportunities in the coming quarters

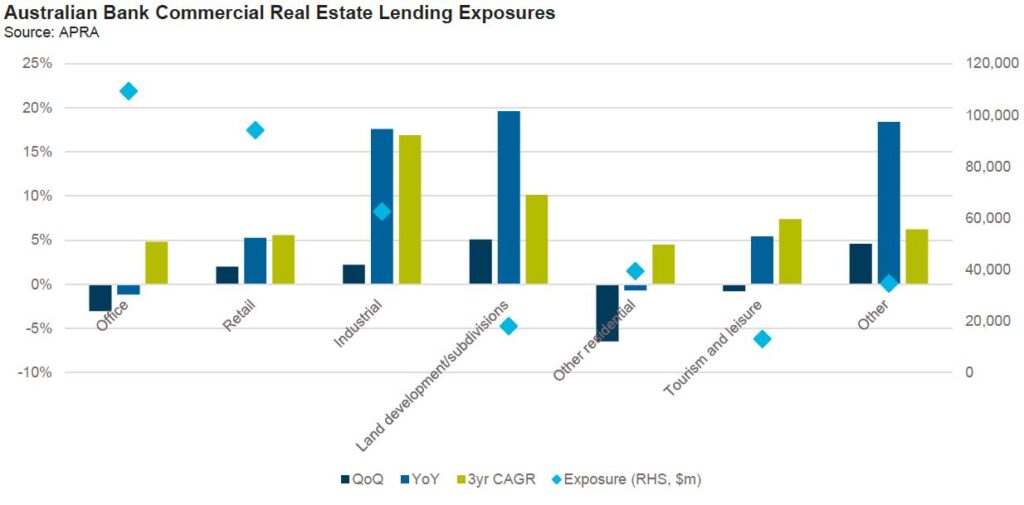

Headlines around the office sector seem to be filtering down to the banking market with APRA reporting that March quarter exposures declined by 3%. This may seem like a small amount but is the largest quarterly decline since 2010.

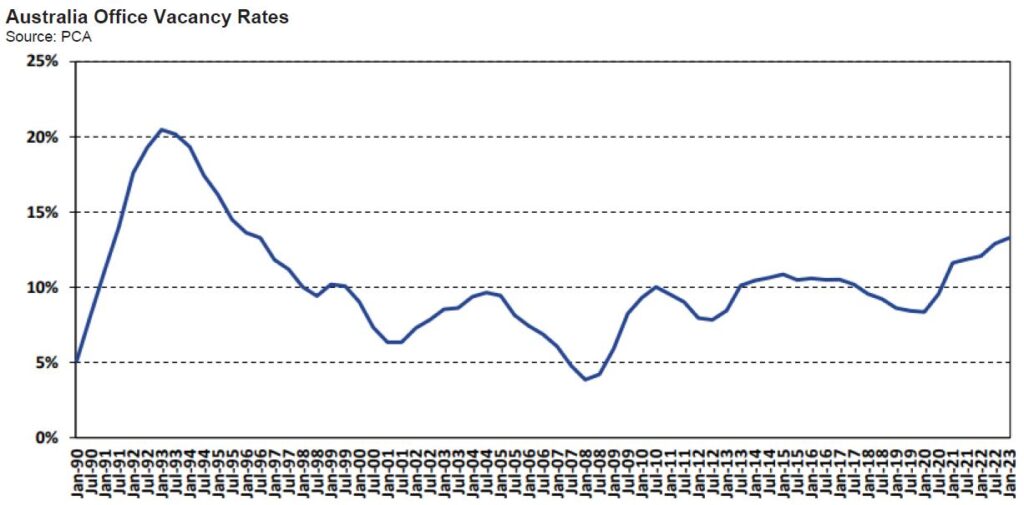

Fundamentals in office remain poor with increasing signs that equity holders are preparing for a significantly tougher environment by starting to preserve distributions to build up capital ahead of refinancings. According to JLL, the headline vacancy rate as at Q1 2023 reached 14.3%, a 0.1% QoQ increase. Gross rents did increases, up 0.8% over the quarter with yields softening 0.19% to 5.62%. There are few signs of improvement in Q2 as the office subsector of the NAB Commercial Property Index moved to -28 from -16 over the quarter.

Away from office, retail is also looking challenged with a weak outlook for rents underpinned by expectations of slower consumer spending. Only industrial is holding up with expectations of 2-3% annual rental increases.

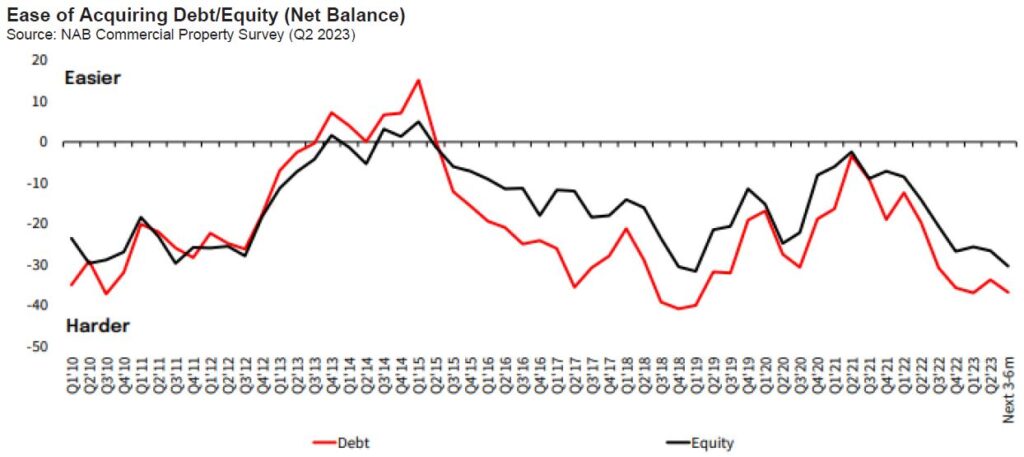

Debt funding conditions remain challenging with the availability of debt very constrained and availability of equity only slightly better.

Pressures facing the construction sector have persisted into the second quarter despite some evidence that asset price declines have reversed. On a trailing 12 month basis insolvencies in the construction sector are the highest on record and despite sharp falls in new building activity, dwellings under construction remain elevated at circa 240,000, above pre-COVID levels of 220-230 thousand. Despite this there are relatively few public signs of distress from private lenders.

Offshore the stress continues to build. According to data from Trepp the special servicing rate for CMBS loans climbed to 6.42% in June, the fifth consecutive monthly increase and an increase of 1.51% over the past 12 months. The office sector continues to underperform increasing to 7.24%, a 3.23% increase since the start of the year. Availability of credit is starting bite with CMBS issuance for the first six months of the year down to US$129 billion, the slowest start to the year since 2012. In Europe, real estate backed bonds continue to trade at a 1.3% wider margin to corporate paper up from 0.3% pre-COVID.

The US$1.6 trillion commercial mortgage backed securities market provides a timelier indication as to what is happening with arrears outside of the banking system. Trepp’s April CMBS delinquency report actually shows a similar trend across the market with 30 day delinquencies actually down over the past 12 months across the entire market (currently 3.1%). This is not equally distributed with strength in lodging, industrial and retail offsetting a sharp decline in office delinquencies which are up over 1% in the past quarter alone and currently sit a 2.6%.

Several high profile defaults have occurred in the office space with Brookfield defaulting on two separate mortgage loans secured by offices in Washington and Los Angeles. And they are not alone with Pimco, a WeWork joint venture, Blackstone and Pimco’s Columbia Property Trust all defaulting on mortgages in recent months. Office valuations are down 25% and vacancies are now over 20% across the entire market.

Thus far in Australia we have seen little of the pressure facing US office markets. Fundamentals are similarly weak with office vacancy rates in the mid-teens, the highest levels since the 1990s. Office attendance remains well below pre-COVID levels with Melbourne peaking at 57% of pre-COVID attendance in November 2022 and Sydney peaking at 61% in February 2023. Even less COVID impacted markets such as Perth and Adelaide CBD are still at levels which are 20% below pre-COVID.

Elevated vacancy rates are flowing through to rents which the latest Financial Stability Review noted are still down 10% on pre-COVID levels. With interest rates increasing at the same time, the rubber is hitting the road at interest coverage. Moody’s have noted that for single asset US CMBS that is maturing in 2023 around 40% has a debt service coverage ratio below 1.1x.

In Australia we have yet to see cap rates move materially but the reality is that they have to. Since the onset of COVID office valuations have increased by over 10% while rents are down 10%. Cost of financing is up considerably with 3 year swap rates up over 3% over the past couple of years. Furthermore, much of the growth in the commercial real estate lending market has occurred in the non-bank sector. Australian banks have not been nearly as aggressive as US regional banks with 3 year CAGRs in the 5-10% area for office and retail, the largest sectoral exposures

As we turn to domestic private lending markets there is little evidence of pressure. But it must be building. A not insignificant share of the market will face interest coverage pressure as existing loans roll off and this will require recapitalisation by equity or some form of forbearance by lenders. We think the opportunity to refinance these loans at attractive pricing and terms will be significant over the coming years.

As we have highlighted all year, patience is key.