While the headlines surrounding Liberation Day have died down in recent weeks, it would be naïve to suggest that the tariff storm is over. It wouldn’t be unreasonable to suggest that we are actually in the eye of the storm. If that is the case, then the question of how to insulate portfolios from the tariff storm is still very relevant.

In this piece we consider how private credit, particularly domestic private credit, is exposed to tariff risks. Is it really shelter from the tariff storm or will the alleged private credit bubble finally burst as a result of a tariff induced slowdown??

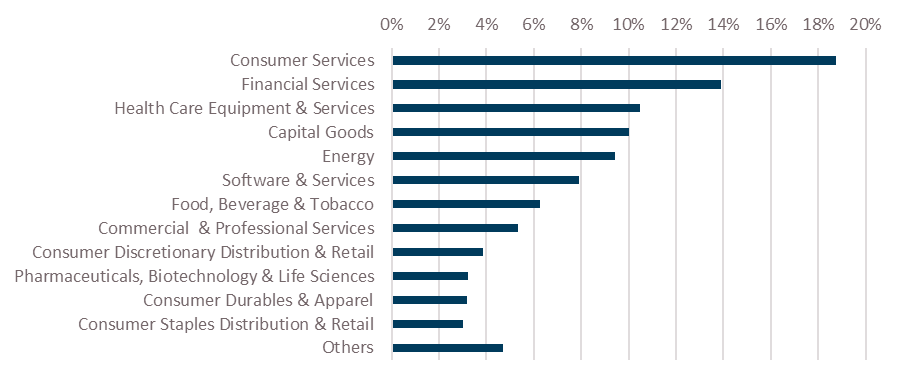

According to Standard & Poor’s, private credit is insulated but not immune to tariff risks with secondary impacts the main concern. Their rationale relates to the sectors that are most typically found in private credit transactions being skewed towards the services sector. Software, healthcare services and business/professional services, circa 40% of S&P’s universe of private credits, are less reliant on physical shipments of goods. Challenger IM’s direct lending portfolio shown below is similarly skewed towards services.

Challenger IM private corporate lending industry exposures

A study by Morgan Stanley had a similar conclusion finding that private credit defaults were more highly correlated with lower ISM Services survey results than lower ISM Manufacturing survey results.

Private credit borrowers are typically smaller than public borrowers, even those private borrowers who are reliant on movement of goods are general more exposed to local supply chain dynamics rather than complex global interactions. Of course, smaller borrowers will generally have less pricing power than larger borrowers and this presents a risk in private markets but one which we expect is less of a factor than the lower overall exposure to the movement of goods.

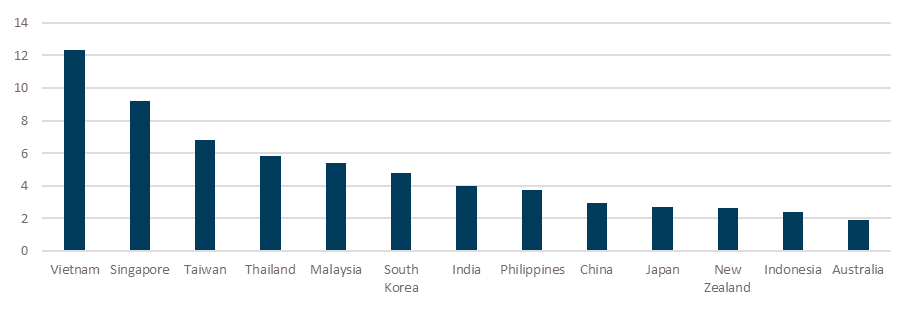

Turning to Australia, these same sectoral themes apply to private credit but with the added bonus that the Australian economy has relatively low exposure to tariff related risks. Recall the US has a trade surplus with Australia and very little of Australia’s exports actually end up in the United States. According to the OECD less than 2% of GDP ends up in the United States.

Value added exposure to final demand in the US (% of economy)[1]

Ultimately the impact of tariffs on the Australian economy will be most pronounced via the transmission effects from China, Australia’s largest trading partner. The RBA[2] found that a negative shock to Chinese exports could impact demand for commodities and thus Australia but with a potential offset from a Chinese domestic stimulus program.

To this point we’ve focussed on corporate direct lending but that of course is only part of the private credit landscape. Commercial real estate lending and asset backed finance are expected to be even less exposed to the direct impacts of tariffs with the greatest concern the implication of higher inflation and potentially higher interest rates placing a burden on borrower’s capacity to pay rents and households ability to service their debts.

The secondary effects are not to be ignored and are likely to outweigh the direct impacts. They will also be lagged as the ripple out across the global economy. In a downside scenario, the inflation shock of higher and widespread tariffs (or even the fear of tariffs) will result in higher unemployment, slower growth and ultimately slower inflation. This, we expect will result in cuts to interest rates which should support private credit which is a floating rate asset class (i.e. as interest rates decline, the interest burden on borrowers will also fall).

Perhaps the most important question that flows from the tariff storm surrounds the implication for the US deficit and the US dollar. Moody’s acted in May, downgrading the US government to Aa1 on the expectation that federal deficits will widen, reaching nearly 9% by 2035 with US federal debt rising to 134% of GDP by 2035. US long term interest rates moved higher with the 30 year rate exceeding 5% for the first time since 2023 and coming within a couple of basis points of the highest level since early 2007.

From one storm to the next!!!

[1] Source: OECD

[2] Potential effects of a US-China trade war on Australia: https://www.rba.gov.au/information/foi/disclosure-log/pdf/232431.pdf

On behalf of the team, thanks for reading.

Pete Robinson

Head of Investment Strategy – Fixed Income | +61 2 9994 7080 | probinson@challenger.com.au

For further information, please contact:

Linda Mead | Senior Institutional Business Development Manager | T +61 2 9994 7867 | M +61 417 675 289 | lmead@challenger.com.au | www.challengerim.com.au

Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client’s objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report.