Early in my career I was introduced to the adage, “you get paid for brain damage”. Despite its crudeness, the expression has proved accurate. Put another way, if you are willing to make the effort to understand and mitigate complexity, you can often get paid outsized returns for doing so.

In the years following the global financial crisis, securitisation markets were viewed as overly complex. Regulatory bodies disincentivised pension funds, banks and insurers from investing in these markets outside of the most risk remote tranches. Investors that were willing to finance mezzanine tranches of securitisation issuance were rewarded handsomely for it.

Fast forward to today and while markets have normalised to a degree the structural opportunity remains. However sophisticated investors have recognised that the real opportunity lies in the manufacturing of new securitisation bonds in private markets, so called warehousing or pre-securitisation finance.

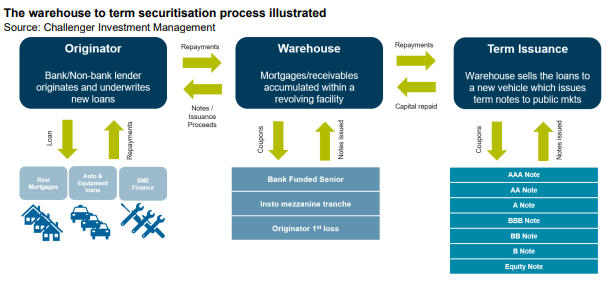

As a reminder a securitisation pools a group of loans/receivables into a pool which are then tranched into bonds of different risk and return profiles. A warehouse is a securitisation that allows a lender to accumulate a sufficient volume of receivables to then issue into the public market.

In the warehouse market the senior financier is typically a bank who will also act as the arranger of the public transaction. Prior to the Global Financial Crisis banks were willing to fund close to (and in some cases even more than) 100% of warehouse with the difference comfortably funded by the originator of the loans. There was no need for anyone to bridge the gap between senior bank funding and equity. The post GFC world is immeasurably different. Basel III capital standards impose extremely punitive capital treatment for banks that lend below investment grade ratings, especially where they are not in the senior tranche. For some asset types, the gap between where banks are willing to lend to and where the originator can fund can be 20-30% of the overall pool of collateral. This is the first piece of the value puzzle for securitisation warehouses.

Regulations have created a structural gap in warehouse funding markets into which alternative lenders have entered

But not just anyone can step into a warehouse. As with many private lending transactions execution risk, ongoing management and certainty of capital are critical considerations for a borrower. Alternative credit funds who are active in warehouse lending will typically have well established intercreditor relationships with multiple senior bank financiers and a long track record of efficient execution of transactions through multiple cycles. Scale also matters; an ability to grow the warehouse over time and even provide incremental capital to de-risk senior is also an important consideration for a borrower. Unlike corporate lending markets where even private transactions have some degree of standardisation, warehouses tend to be bespoke to meet the specific needs of the borrower. Having experienced counterparties who are a known quantity can reduce the cost and risk of execution. You may ask why cost and risk of execution are so important in securitisation warehouse transactions. The answer lies at the heart of the second, and in our view most important piece of the value puzzle.

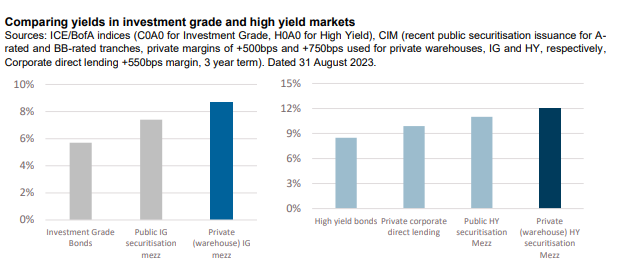

Securitisation warehouses are a means to an end

Securitisation originators make their returns by terming out warehouses into public markets at the lowest possible cost of funds. The warehouse allows the originator to get a sizeable enough portfolio that meets the specific needs of the public market securitisation investors, thus lowering the cost of funds. The goal of the warehouse is to get to the public markets as quickly and efficiently as possible. Experienced originators understand that the trade-off for the speed and efficiency in the warehouse is higher returns to the warehouse financiers. For the senior banks, the higher returns come through transaction fees for arranging and distributing the public securitisation. For the alternative credit funds providing the mezzanine finance, the margins in warehouses are generally around 2% per annum higher than the margins in public term transactions of the same implied credit ratings. With cash returning close to 5% across most developed markets, the all-in yield on a warehouse trade is in the low teens for a credit risk profile that often blends to around a BB credit rating. This is a considerable pickup over the high yield bond market which is only yielding around 7% in US dollar markets.

The final piece of the value puzzle relates to risk and is strongly tied to the “means to an end” argument. Because the warehouse is such an integral part of the value creation chain, borrowers have tended to go to great lengths to maintain the performance of their warehouses. This includes putting in additional equity/subordination, buying back non-performing receivables or targeting a lower risk profile with new originations. Subordination levels are also typically set based on a hypothetical ‘worst case’ pool based on eligibility criteria and portfolio parameters meaning that required subordination levels are higher than what they would be based on the actual pool.

While we think there is a strong case for securitisation warehouses being lower risk than public market securitisations, it is important to acknowledge that they can be dangerous in the wrong hands. After all, these are mezzanine tranches where 100 cents in the dollar can be lost if there is a default. Potential investors need to be wary of this and understand the key risks which include:

- Intercreditor terms: what can senior agree to without mezzanine consent? More aggressive

documentation can cede all consent rights around document amendments, waivers and audits to the senior financier only - Enforcement rights: if the warehouse is not performing as expected, what are the rights of the senior financier? Can they enforce without mezzanine consent and if so, in what circumstances? What rights does the mezzanine financier have in an enforcement scenario?

- Financial strength of the originator: if there is deterioration in the performance of the warehouse, what is the ability of the originator to rectify by adding subordination or buying back receivables?

- The exit: how does the mezzanine lender exit the facility in the event that they need to without triggering an amortisation of the warehouse where senior is repaid in priority?

The securitisation warehouse market is one of the more esoteric parts of a private lending landscape that is rapidly gaining the attention of investors across the globe. The more mainstream parts of the US and European direct lending landscape are now characterised by a group of mega funds increasingly competing with public markets (and each other) to provide multi-billion dollar leveraged buyout debt packages. The next, and in our view most attractive, opportunities in private debt lie in more niche subsectors and geographies which remain off the radar of these mega funds.