The Trump Administration wants US$12 trillion defined contribution plans to get into private markets. But what does the democratisation mean for private markets? Will greater ease of access result in significant flows and if so, what are the implications for private markets?

Last week the Trump Administration issued an executive order directing the US Department of Labor to evaluate (within the next 180 days) regulatory changes designed to broaden the investment options available to participants in defined contribution schemes, included 401(k) plans.

What is a 401(k) plan?

The 401(k) is an employer-sponsored retirement savings account which allows employees to contribute their pre-tax salary towards retirement (sound familiar?). The largest plan providers who administer 401(k) plans on behalf of employers are Fidelity, Vanguard and Empower. 401(k) plans represent around 70% of total DC assets.

According to a report by Investment Company institute[1], the US retirement savings market is roughly US$43 trillion which includes corporate and government defined benefit schemes, 401(k) defined contribution schemes and Individual Retirement Accounts (IRAs). Around 50% of US private sector workers participate in defined contribution schemes with assets under administration growing at a CAGR of 6% from Q12015 to Q12025, with most of that due to equity returns (the S&P500 delivered a CAGR of around 12% over the same period).

Unlike in Australia, defined contribution schemes in the United States are in net outflow which is expected to increase as more baby boomers retire. DC plans have also lost assets to IRAs which have grown at 9% over the past decade, contrasting with self-managed funds in Australia where market share has declined from 33% to 28% over that same period.

Another key difference between 401k plans and defined contribution plans in Australia is that the 401(k) plans are run by the private sector while in Australia 40% of retirement assets are managed by profit for member funds. In the United States, much of the lobbying in favour of expanding 401(k)s to private assets has not come from the plan administrators or the plan members themselves but from private market asset managers who see an opportunity to provide higher margin investments to plan members.

What do 401(k)’s currently invest in?

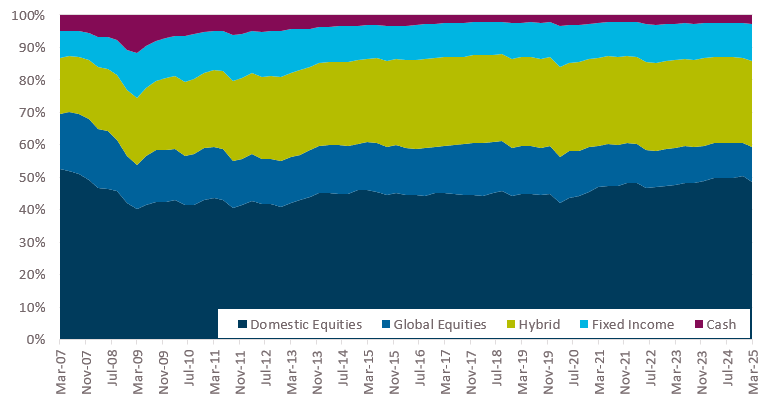

Despite being in net outflow, 401(k) plans are heavily weighted towards equities with a 59% allocation as at the end of March 2025 plus another 27% in hybrid funds which blend equities and fixed income including target date and lifestyle mutual funds.

The asset allocation compares reasonably well with Australian superannuation funds which also held 59% in equities at March 2025 alongside a 19% allocation to fixed income, a 5% allocation to Cash with the remainder in alternatives including infrastructure, property and private debt. The big distinction is the allocation to unlisted assets which totals around 19% of domestic fund allocations and nothing in 401(k)’s.

401(k)’s has historically limited investment options to public market securities due to regulatory, fiduciary and liquidity considerations. Participants in 401(k) plans have expected daily valuations and daily liquidity and plan providers have historically interpreted their fiduciary obligations narrowly, focussed less on the return objective and more on their obligations to provide participants with immediate access to their funds. In 2020, the US Department of Labor clarified that private market investments are not restricted from 401(k) plans and that fiduciaries would not be in violation of ERISA if they include private market investments in a 401(k) plan.

Operational considerations have also limited access to private markets. Many existing plans allow for individuals to change investment options on a daily basis with DoL guidelines allowing requiring an employer to allow participants to change at least quarterly.

401(k) Plan Asset Allocation over time

So, what next?

With the specific constraints facing 401(k) plan providers, the most immediate opportunity is for private market asset managers to partner with plan providers to offer products such as target date funds that blend public market assets for liquidity with a smaller (5-20%) allocation to private markets. Already Voya Financial and Blue Owl have entered into a strategic partnership to bring private market investments to defined contribution plans. Empower has aligned with Apollo, Goldman Sachs, Partner Group and others to develop investment products.

Much of the activity is focussed on private credit rather than other private assets. Private credit is well suited to target date funds as they have offered some level of liquidity via regular maturities of underlying investments and provide regular income. Fees are generally lower than private equity funds and valuation risk is lower.

Defined benefit schemes held around US$200 billion in private credit assets, around 2-2.5% of total assets under management, though this figure is growing. A similar allocation from defined contribution schemes would result in an additional US$240-300 billion in demand, equivalent to around 10% of the size of the current private credit market though with the greater liquidity needs of defined contribution schemes we suspect that this demand will be much more moderate, at least initially.

And what does this mean for private credit?

We think that 401(k)s will allocate to private credit though perhaps not to the traditional corporate direct lending market. “Investment grade private credit” is already being heavily promoted by private credit asset managers although this comes with a lower illiquidity premium; Voya Financial quotes a historical total return advantage of 114 basis points for IG private credit which compares to HY private credit illiquidity premiums of more than 200 basis points (though both are much lower today with HY private credit at 160 basis points according to Cliffwater). To access the 401(k) market, private market providers will have to accept lower fees. Much like defined contribution funds in Australia, 401(k) plans are very fee sensitive with an average fee rate of around 0.85% p.a. Average fees on equity mutual funds were 0.31% for 401(k)’s, much lower than the dollar weighted average of 0.42% per annum. On their higher returning private credit options, it seems unlikely that asset managers will be willing to reduce fees sufficiently to meet the market and will continue to focus on expanding in high new worth channels where fee pressures are lower. Instead, we suspect managers will introduce new lower returning products where there is not the same level of competition (i.e. investment grade private credit).

Anecdotally the same is true of Australia where private credit allocations have barely moved over the past few years for superannuation funds (June 2022 private credit allocation was 1.1% same as March 2025). The less fee sensitive retail funds have a 1.4% allocation, with industry funds at 1.1% allocation at March 2025.

The democratisation of private credit is a lofty goal but one we suspect will be difficult to achieve. Defined contribution schemes will add to overall levels of demand for private credit but perhaps not as materially as may have first appeared. There are still significant impediments to demand widespread take up of private credit and product providers appear to be pushing investors towards lower fee private credit alternatives, rather than the traditional parts of the market.

[1] https://www.mckinsey.com/industries/financial-services/our-insights/the-us-retirement-industry-at-a-crossroads

On behalf of the team, thanks for reading.

Pete Robinson

Head of Investment Strategy – Fixed Income | +61 2 9994 7080 | probinson@challenger.com.au

For further information, please contact:

Linda Mead | Senior Institutional Business Development Manager | T +61 2 9994 7867 | M +61 417 675 289 | lmead@challenger.com.au | www.challengerim.com.au

Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client’s objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report.