The financial system of the United States is unique. Unlike Australia where households and institutions are at the mercy of the four major banks, the US banking system is highly dispersed. There are over 4,000 commercial banks and over 500 savings and loan associations. The top 4 banks represent less 50% of total assets in the banking system; in Australia this figure is over 70%.

With so many individual lenders, the Federal Reserve Board (the Fed) conducts a quarterly survey to gauge the degree to which financial conditions are changing. This is called the SLOOS, the Senior Loan Officer Opinion Survey on Bank Lending Practices. The survey polls up to 80 large domestic banks and 24 branches of individual banks. The questions address the degree to which banks are tightening lending standards, how the demand for credit is evolving as well as how the pricing of credit risk is changing. The results of the survey are reported to the Federal Open Market Committee (FOMC) and feed into monetary policy decision making.

The survey has been repeatedly shown to have high predictive content with a tightening in lending standards being strongly correlated with a slowing in GDP growth.

In this month’s “What We’re Watching” we take a closer look at the Senior Loan Officer Survey in an attempt to identify the degree to which standards are tightening and where the tightening is most acute.

Observation 1: Previously when banks tightened by as much as they have done to date, a recession has followed

A challenge in interpreting the survey data is that the questions asked of the banks have binary responses with the measure tracking the net percentage of respondents answering in the affirmative. It gives no indication as to the degree to which standards were tightened or pricing increased. There are also small biases in responses; for example, a bias towards tightening of credit standards with an average 6% of net respondents indicating tightening for C&I loans since 1990.

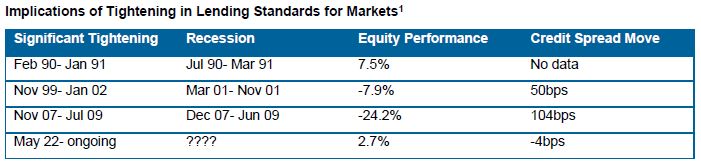

Since 1990 there have been 4 periods of significant tightening in credit standards (which we define as 4 consecutive quarters where 20% or more of net respondents reporting tightening in standards for C&I loans). All 3 previous periods of significant tightening in credit standards were followed by a recession and in two of the 3 a selloff in credit and equity markets.

There have also been several periods where banks have meaningfully loosened credit standards. The mid 1990s (mid 93 to mid 95) and mid 2000s (early 04 to mid 06) saw extended periods of loosening lending standards. More recently banks loosened lending standards from early 2021 to mid 2022 including the most negative net percentage of respondents reporting tightening on record; -32.4% for the quarter ended Jul-21 (although it is arguable that some of this loosening was a reversal of the sharp tightening we saw when COVID hit).

Our take is that the tightening in lending standards is not over. While standards were not excessively loose in 2022, we think the tightening will eventually weigh on risk markets.

Observation 2: pricing on C&I loans is increasing

The SLOOS also asks banks whether they are increasing spreads of loans over the Banks’ cost of funds. Historically banks have had a slight bias towards tightening pricing albeit with responses being far more volatile than responses around lending standards.

Interestingly the correlation between tightening in lending standards and changing spreads is only around 60%. Banks tend to reach a point where they are unwilling to loosen lending standards any further but are still willing to compete on price. For example, banks tightened pricing on C&I loans for longer periods than they loosened credit standards; from early 1993 to mid 1998 and from mid 2003 until mid 2007, respectively. In contrast, when standards tighten banks tend to also widen pricing concurrently.

The widening in pricing has two effects – it further exacerbates credit pressure on borrowers, especially when combined with the significant increase in base interest rates. Secondly it creates opportunities for alternative lenders to disintermediate the banks.

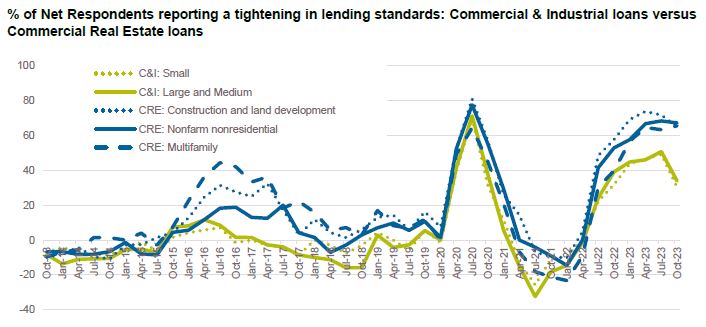

Observation 3: CRE lending standards are far tighter than C&I lending standards

Commercial real estate (CRE) lending standards have tightened by far more than commercial and industrial loans. Demand for credit has also declined to levels not seen since the Global Financial Crisis (GFC). Even sectors such as Multifamily which are performing relatively well in a fundamental sense are experiencing a sharp tightening in lending standards.

To date, non-farm non-residential CRE lending has experienced 5 consecutive quarters where more than 50% of net respondents have tightened lending standards. The longest such period on record was the GFC with 7 quarters. No other period since 1990 has seen more than 2 consecutive quarters of >50% net respondents tightening credit standards.

Observation 4: The consumer is still okay

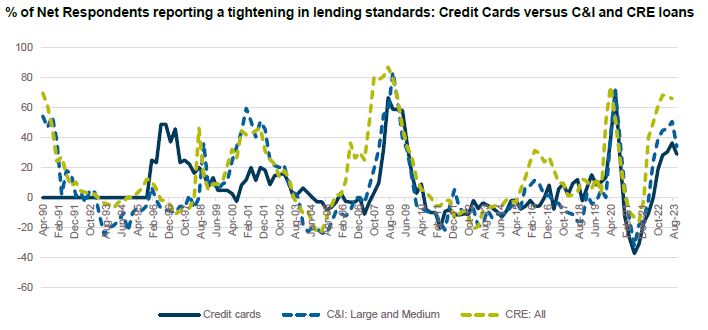

The survey data for credit cards implies a far less severe tightening in credit standards. The leadup is similar with the 2020 tightening and 2021 loosening in credit standards tracking closer to C&I and CRE loans but paths diverge in late 2022. New and used auto loans have experienced even less of a tightening in standards than credit cards.

Residential mortgages, the epicentre of the GFC, have also not experienced a material amount of tightening in credit standards.

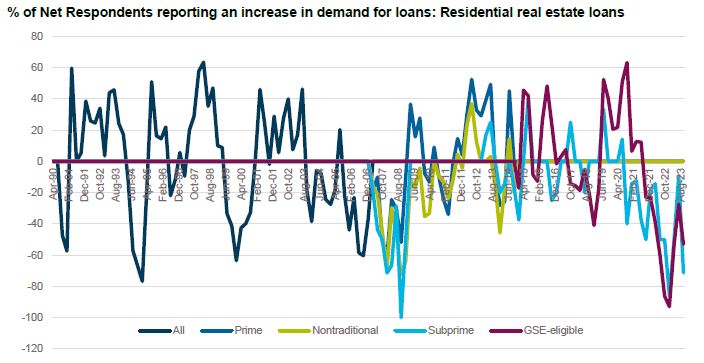

Demand for consumer credit, both secured and unsecured has also not picked up materially with a reduction in demand being reported for auto loans and consumer loans ex credit cards and auto loans. However, demand for mortgages has fallen to GFC lows, in large part due to mortgage rates which are around 8%, levels not seen for more than 20 years.

Domestic survey data

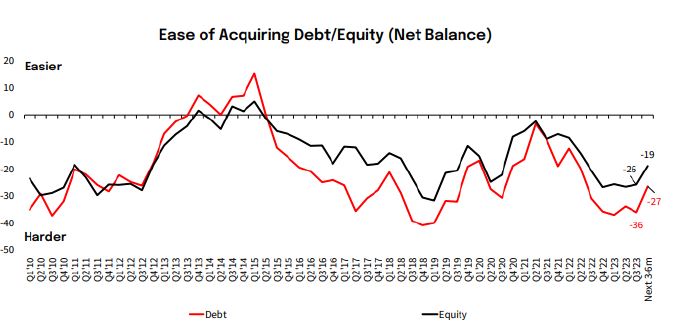

While APRA does not collate consolidated survey data on lending conditions, several banks conduct their own surveys. NAB completes a quarterly survey on commercial property markets where borrowers have reporting difficulties in accessing credit with availability in line with pre-COVID levels. This suggests that while credit standards for real estate lending are tightening in Australia, they are not tightening at the same pace as in the United States.

In conclusion…

Despite the relatively benign indications in Australia, the SLOOS implies a far sharper tightening in credit conditions especially in commercial real estate lending markets. Pricing of risk is also heading higher. While we don’t necessarily expect tighter lending conditions in the US to flow directly to Australia (in aggregate our banks are in a stronger capital and liquidity position than the US banking system), we do think the tighter conditions in the US may precipitate an increase in risk premiums across markets.

After all, when the US sneezes, the rest of the world catches a cold.

[1] All the data in this report is sourced from the SLOOS which is produced by the Federal Reserve. https://www.federalreserve.gov/data/sloos.htm